The African startup ecosystem, especially the mobility, clean energy, and fintech sectors, gained additional momentum last week with investors doubling down on participation in these thriving industries. Highlights include Anda’s €3M seed for Angolan motorcycle taxis, Sawa Energy’s €2.5M solar expansion, and nextProtein’s €18M Series B in Tunisia. These deals signal sustained investor appetite for scalable, climate-aligned, and digitally enabled African startups.

- FUNDING

- EXITS

- INVESTOR ACTIVITIES

- Ventures Platform Secures $64M First Close for Pan-African Fund II

- First Circle Capital Raises $6 Million from IFC for Early-Stage Fintech

- Meta Llama Impact Accelerator 2025 Backs 12 African AI Startups

- KCB Group Acquires Minority Stake in Pesapal

- EIB Backs Amethis Fund to Expand European SMEs in Africa

FUNDING

Anda

Funding Round: €3 Million Seed

Investor(s): Breega, Speedinvest

Founder(s): Sergio Tati, Joerg Nuehrmann

Founded in: Angola (2021)

About Company

Anda operates a ride-hailing and last-mile delivery platform connecting riders and drivers through a mobile app. Its core innovation is a drive-to-own motorbike financing model, which lets drivers pay off vehicle loans gradually while earning income. The system offers a formal alternative to Angola’s largely informal motorcycle taxi sector, which counts an estimated 1.2 million operators, including over 600,000 in Luanda. Anda integrates logistics, payments, and data tracking to improve earnings, rider safety, and service efficiency.

What’s Next

The €3 million seed funding will support expansion across Angolan cities and into other African markets. Anda plans to enhance its technology infrastructure, scale its rider network, and deepen asset financing options for drivers. The startup aims to professionalise urban mobility while increasing transparency and generating data for city transport planning. Investors see the round as a milestone in Africa’s mobility sector, demonstrating the potential of VC-backed solutions in informal economies.

Sawa Energy

Funding Round: €2.5 Million Equity

Investor(s): ElectriFI (EU-backed, managed by EDFI)

Founder(s): Samuel Kaufman

Founded in: Uganda/Rwanda (2021)

About Company

Sawa Energy develops, finances, and operates solar PV and battery storage systems for commercial and industrial clients. The startup provides electricity under long-term power purchase agreements, allowing businesses to avoid upfront capital costs. Its portfolio currently covers 32 projects totalling 2.6 MWp of solar capacity and 1 MWh of storage, serving major clients including MTN and I&M Bank. Sawa combines renewable energy solutions with operational reliability to reduce dependence on diesel generators and improve energy cost predictability for firms across East Africa.

What’s Next

The ElectriFI equity investment will fund pipeline expansion to reach 35 MW of installed C&I solar capacity by 2030. Projects will replace diesel-powered systems with solar-plus-storage, lowering emissions and energy costs. Sawa plans to accelerate deployment, attract additional institutional investors, and scale commercial operations in Uganda and Rwanda. The funding aligns with EU initiatives to advance decentralised clean energy in Africa’s industrial sector.

nextProtein

Funding Round: €18 Million Series B

Investor(s): Swen Capital Blue Ocean Fund, British International Investment (BII), Société Générale, CIC Paris Innovation, La Banque des Start-ups (LCL)

Founder(s): Mohamed Gastli, Syrine Chaalala

Founded in: Tunisia (2017)

About Company

NextProtein produces sustainable insect-based ingredients for animal feed, using Black Soldier Fly larvae grown on low-value agricultural byproducts. Its portfolio includes protein powder (nextMeal), insect oil (nextOil), and organic fertiliser (nextGrow). The company applies circular production methods to reduce reliance on fishmeal and soy imports while cutting environmental impacts. Its industrial model focuses on cost efficiency, scalability, and traceability, enabling mass-market adoption of insect protein as a mainstream feed component.

What’s Next

The Series B funding will build a new large-scale facility in Tunisia with an annual output of 12,000 tonnes of insect-based feed. NextProtein aims to expand industrial production, meet growing regional and European demand, and scale sustainable aquaculture and livestock inputs. Investors highlight the company’s potential to reduce pressure on marine resources while supporting a climate-smart food system in Africa and beyond.

WildyNess

Funding Round: Undisclosed Pre-Seed

Investor(s): Bridging Angels, African Diaspora Network

Founder(s): Achraf Aouadi, Rym Bourguiba

Founded in: Tunisia (2021)

About Company

WildyNess is a travel marketplace connecting tourists with community-hosted experiences. The platform supports micro-entrepreneurs in designing tours that showcase local culture while promoting economic inclusion and environmental responsibility. Since launch, the startup has generated over $300,000 in organic sales without paid marketing. WildyNess provides tools for booking, payment, and community engagement, creating an ecosystem for authentic, locally led tourism.

What’s Next

The funding will expand operations into Algeria, Saudi Arabia, Oman, and the UAE. WildyNess plans to scale provider onboarding, improve platform technology, and strengthen cross-border logistics. The startup’s approach integrates sustainable practices with local economic empowerment, aiming to establish a North Africa and MENA network for responsible travel experiences.

Farm to Feed

Funding Round: $1.5 Million Seed

Investor(s): Delta40 Venture Studio, DRK Foundation, Catalyst Fund, Holocene, Marula Square, 54Co, Levare Ventures, Mercy Corps Ventures

Founder(s): Claire van Enk, Anouk Boertien, Zara Benosa

Founded in: Kenya (2021)

About Company

Farm to Feed connects smallholder farmers with buyers for surplus or imperfect produce via a digital marketplace. The platform uses mobile apps, USSD channels, and data-driven traceability to ensure product quality. To date, it has onboarded over 6,500 farmers and redistributed more than 2.1 million kilograms of produce, preventing 247 tonnes of CO₂ emissions. The startup addresses systemic inefficiencies that leave up to 40% of African food unconsumed.

What’s Next

The capital will fund technology upgrades, regional expansion, and development of semi-processed product lines. Farm to Feed aims to increase farmer income, reduce post-harvest losses, and improve supply chain resilience. The startup also plans to integrate climate-smart logistics and expand digital payment solutions for producers, reinforcing a circular food economy.

Chari

Funding Round: Undisclosed Series A Extension

Investor(s): DisrupTech Ventures

Founder(s): Ismael Belkhayat, Sophia Alj

Founded in: Morocco (2020)

About Company

Chari is a B2B e-commerce and fintech platform enabling small shops to order consumer goods and access embedded financial services. Its licensed payment infrastructure allows domestic and international transfers, micro-insurance, and digital account issuance. The platform already serves over 20,000 retailers and integrates financial tools with supply chain solutions to formalise informal retail networks.

What’s Next

DisrupTech Ventures’ investment supports Chari’s expansion across Francophone Africa, strengthening fintech infrastructure and retail distribution. The funding will accelerate the onboarding of new retailers, optimise operational efficiency, and scale embedded finance solutions. The partnership positions Chari to deepen financial access at the grassroots level and reinforce digital commerce across Morocco’s informal economy.

EXITS

Beltone Venture Capital Exits Cathedis with 100% IRR

Beltone Venture Capital (BVC) has announced its exit from Cathedis, Morocco’s leading last-mile delivery startup, achieving a 100% internal rate of return (IRR). This marks BVC’s first exit outside Egypt and its third successful liquidity event since the firm’s inception. The transaction reflects BVC’s strategy of backing technology-driven companies across North Africa and the Middle East.

BVC, founded in 2023, manages approximately US$50 million across 21 tech-enabled companies, including a US$5 million venture-debt portfolio. The investment in Cathedis supports the expansion of last-mile delivery infrastructure and operational scaling. BVC’s active engagement helped accelerate growth and operational maturity. CEO Ali Mokhtar highlighted the firm’s ability to create value through targeted support, while Cathedis CEO Omar Alami noted the exit validates the startup’s long-term vision for accessible e-commerce infrastructure in Morocco. The transaction demonstrates both the potential of regional venture-backed logistics companies and the growing sophistication of the MENA investment ecosystem.

INVESTOR ACTIVITIES

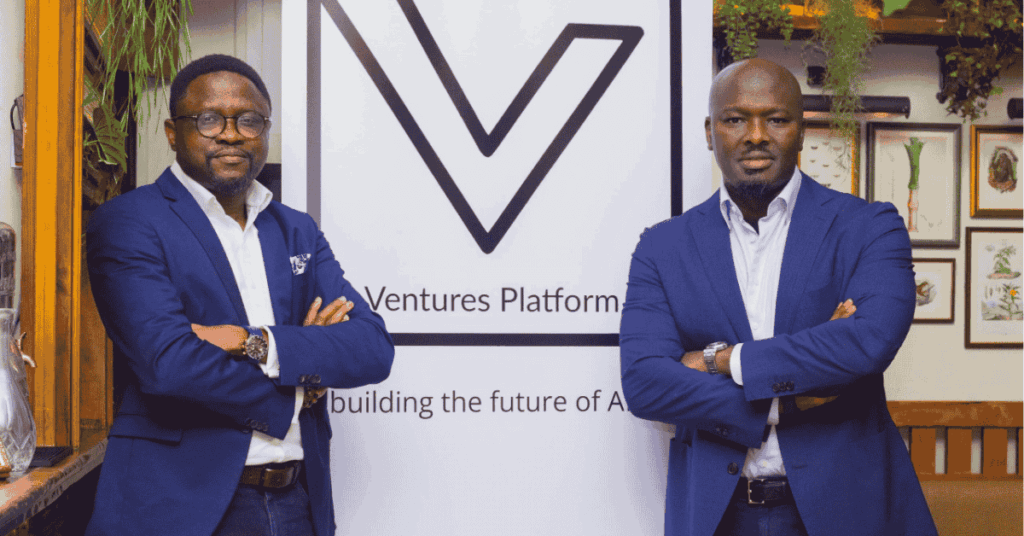

Ventures Platform Secures $64M First Close for Pan-African Fund II

Nigerian venture capital firm Ventures Platform has closed the first tranche of its second institutional vehicle, VP Pan-African Fund II, raising $64 million. The fund targets African startups across fintech, healthtech, agritech, edtech, and AI, with a final close expected at $75 million. Approximately 70% of commitments come from Ventures Platform’s first fund, signalling strong investor confidence. Key participants include IFC, Standard Bank, BII, Proparco, iDICE, MSMEDA, and European family offices.

Fund II expands the firm’s mandate into Series A investments while maintaining early-stage expertise. The fund will support startups addressing non-consumption gaps, infrastructure bottlenecks, and critical service needs across Africa, with a focus on Nigeria, Francophone West Africa, and North Africa. Ventures Platform has backed over 90 companies since 2016, including Moniepoint, Thrive Agric, OmniRetail, PiggyVest, and Remedial Health. The $64 million first close highlights the growing appetite for Pan-African technology investments and strengthens Ventures Platform’s ability to scale startups across borders while promoting financial inclusion, infrastructure development, and regional tech adoption.

First Circle Capital Raises $6 Million from IFC for Early-Stage Fintech

African VC First Circle Capital has secured $6 million from the International Finance Corporation (IFC) to invest in pre-seed and seed-stage fintech startups. Anchoring a larger $30 million fund, the investment will back approximately 24 fintech companies across Africa, focusing on payments infrastructure, digital banking, embedded finance, regtech, and insurtech.

The fund supports startups operating in multiple markets, with 30% of portfolio companies led or co-founded by women. Additional backing comes from We-Fi, the Dutch Good Growth Fund, FSD Africa, MSMEDA, and the Axian Group. First Circle provides operational and business development support alongside financing, preparing startups for Series A readiness. IFC’s participation signals institutional confidence in Africa’s early-stage fintech ecosystem. The fund aims to address critical financial infrastructure gaps, scale inclusive solutions, and create a robust pipeline of digital finance companies capable of delivering cross-border impact in payments, lending, and financial inclusion.

Meta Llama Impact Accelerator 2025 Backs 12 African AI Startups

Meta has selected 12 African startups for its 2025 Llama Impact Accelerator, supporting AI and large-language-model applications across healthcare, education, agriculture, and public services. The program received over 1,400 applications from Nigeria, Kenya, Senegal, and South Africa, with 40 startups entering a six-week sprint for mentoring, technical support, and access to Meta tools. Winners received US$10,000–25,000 prizes and ongoing six-month post-program support, including business advisory, technical assistance, and investor connections.

National winners include Nigeria’s MARMAR, Purple Labs, and DAWN AI Study; Kenya’s DPE, Esheria Ventures, and Neural Labs Africa; Senegal’s Kajou, SamaCoach, and LOOKA Research; and South Africa’s eFama, CatalyzU, and Four Minute Medicine. The program prioritises accessible, scalable AI solutions addressing local problems. By connecting African startups to global resources, Meta aims to position the continent as a growing hub for AI innovation, providing funding, mentorship, and international visibility to promising ventures.

KCB Group Acquires Minority Stake in Pesapal

KCB Group Plc has agreed to acquire a minority stake in Pan-African payments company Pesapal. The transaction, pending regulatory approval, enables KCB to expand digital payment services across East Africa. Pesapal, founded in 2009, operates in Kenya, Uganda, Tanzania, Rwanda, and Zambia, supporting mobile money, card, and online payments for retail, hospitality, travel, petroleum, and manufacturing sectors.

Under the deal, Pesapal retains independent operations while KCB leverages its 455-branch network, 1,224 ATMs, and 1.3 million merchants and agents to strengthen adoption. The partnership integrates KCB’s banking infrastructure with Pesapal’s digital platform, supporting SMEs and enabling seamless cross-channel payments. The investment aligns with KCB’s broader fintech strategy, complementing earlier stakes in Riverbank Solutions. By combining digital banking and merchant services, KCB and Pesapal aim to enhance financial inclusion and commercial efficiency across East Africa.

EIB Backs Amethis Fund to Expand European SMEs in Africa

The European Investment Bank (EIB) has invested €20 million in the Amethis Europe Expansion Fund, a €143 million vehicle targeting European SMEs expanding into Africa, Europe, and the Middle East. Managed by Amethis, the fund provides growth capital, strategic support, and market entry assistance. Key sectors include agribusiness, healthcare, logistics, financial services, telecoms, and consumer goods.

The investment strengthens Europe-Africa economic ties and aligns with the EU Global Gateway strategy. Amethis, founded in 2011, manages over €1.4 billion in assets and has completed more than 30 investments. The fund offers European SMEs capital, operational guidance, and regional networks to scale locally. EIB’s commitment highlights the importance of cross-continental investment partnerships and provides a roadmap for the sustainable expansion of European enterprises into African markets, combining financial support with strategic advisory to foster innovation, employment, and economic growth.