June witnessed a flurry of activity in the African startup ecosystem, with several notable funding rounds making headlines. The dynamic funding landscape showcased a mix of pre-seed, seed, and series funding rounds, underscoring the growing investor confidence in the continent’s entrepreneurial potential. In this edition, we delve into the funding landscape of African startups during June, exploring success stories, key trends, and potential opportunities that lie ahead, backed by data and insights.

Key Highlights:

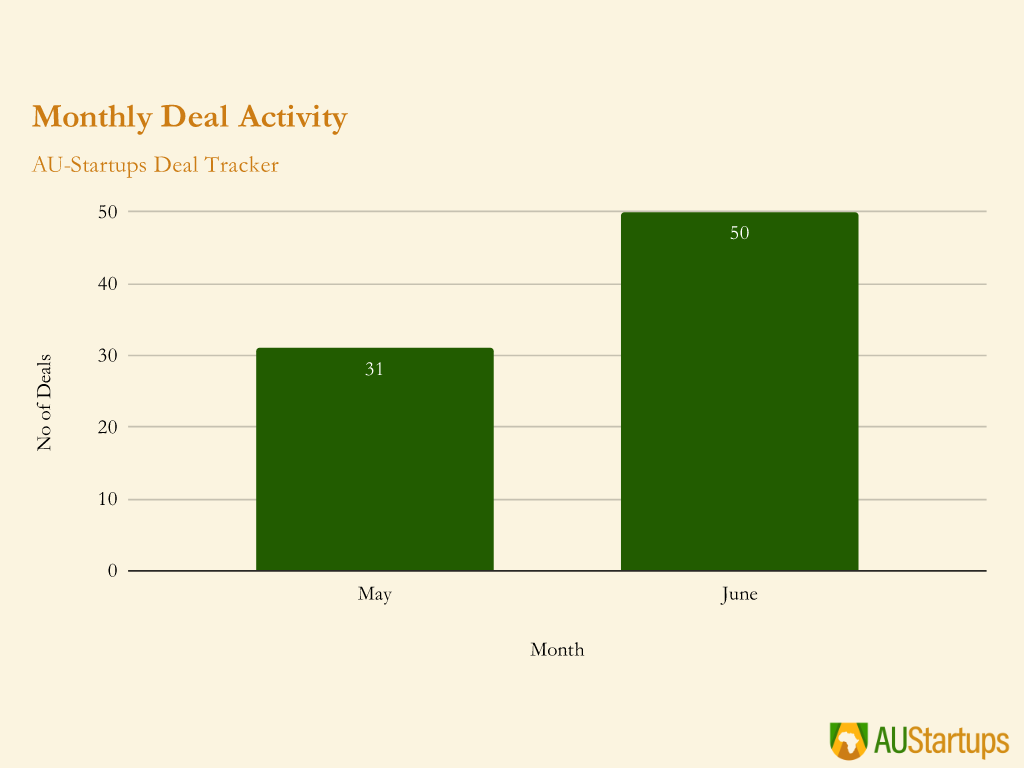

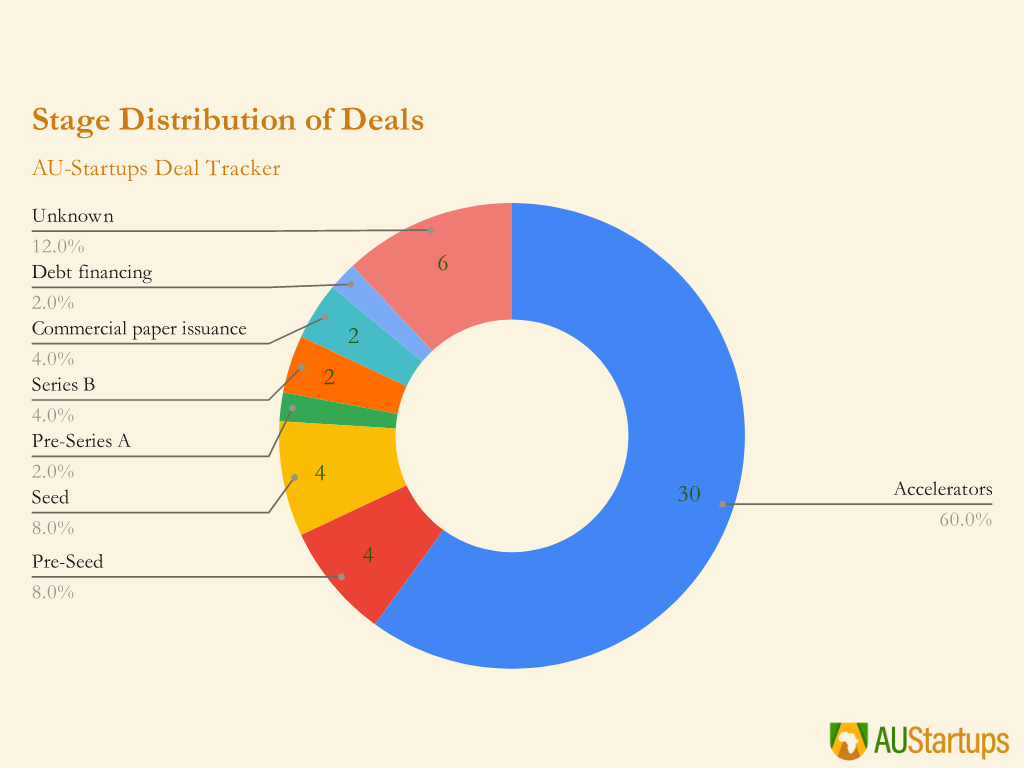

- A surge in Funding Deals: June saw a total of 50 funding deals recorded, marking a significant increase from the 31 deals in May. Early-stage programs’ active involvement played a pivotal role in driving this surge.

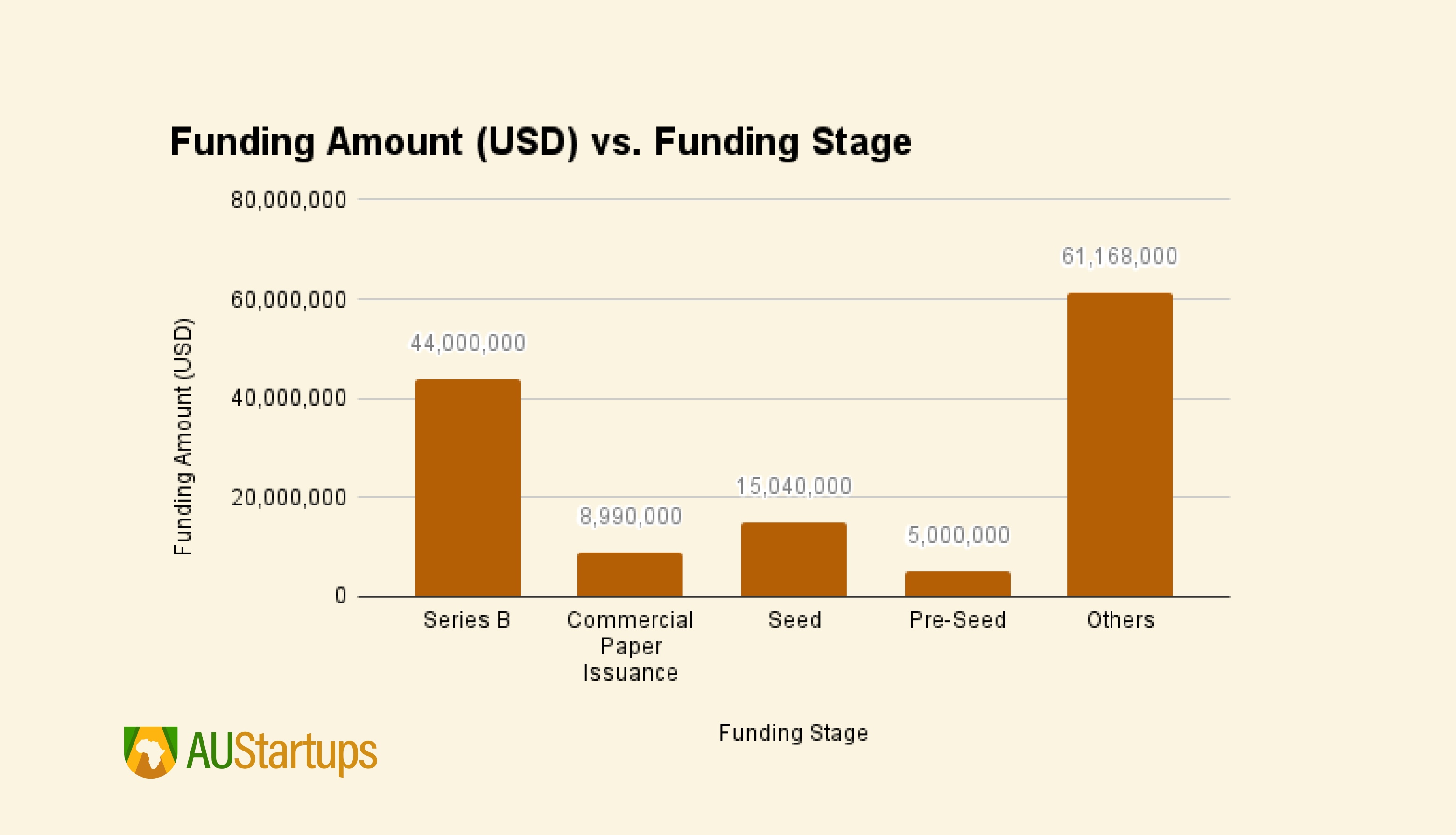

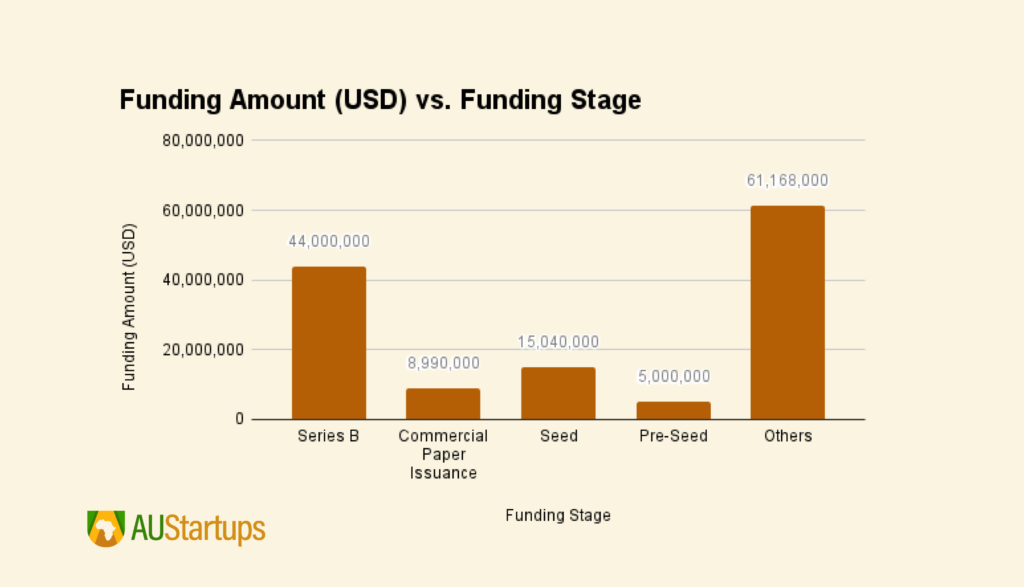

- Standout Funding Rounds: Notable funding rounds included Helium Health’s Series B round, raising $30 million, and Yellow securing $14 million. Additionally, lending platforms Fairmoney and Fast Credit raised $5.39 million and $3.6 million, respectively, through commercial paper issuance, showcasing an intriguing funding alternative.

- Sector Distribution: Logistics and fintech dominated the sector distribution, claiming the highest number of investment deals in June. Logistics startups secured 22% (11) of all recorded deals, closely followed by fintech with 20% (10) of the total deals. In the previous month, fintech accounted for the largest share of deals at 35.5% (11), while healthtech came in second with 16% (5) of the total deals. Notably, the e-commerce and healthtech sectors witnessed significant funding rounds, adding further diversity to the investment landscape.

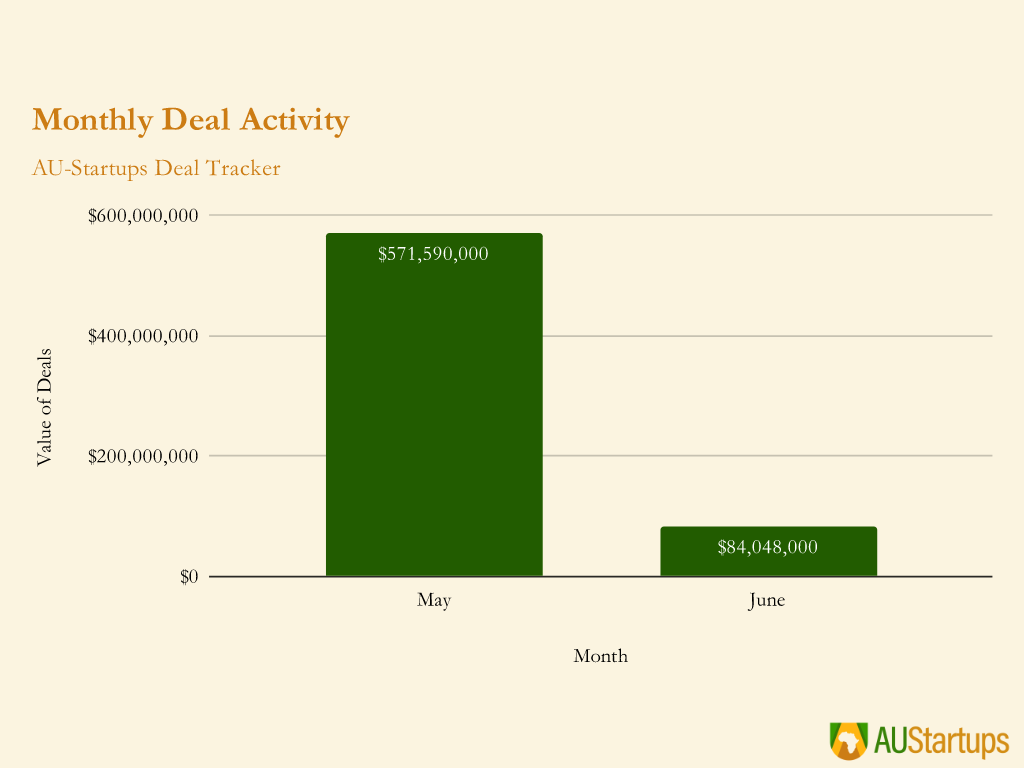

- Total Disclosed Funding: Total disclosed funding amounted to $84 million, significantly lower than the previous month’s figure of over $571.5 million. This disparity can be attributed to the exceptionally high funding rounds for M-KOPA and Sun King in May.

- Early-Stage Focus: With 68% of all recorded deals occurred in pre-Series A stages. The ecosystem welcomed two early-stage programs and the launch of three venture capital funds, further contributing to the upswing in early-stage investment activities.

- Continued international interest: The involvement of global investors, such as AXA Investment Managers and Convergence Partners, in funding rounds further highlights the growing international interest in African startups. These investments not only provide financial support but also open doors to expertise, networks, and market opportunities.

Noteworthy Investments

- Helium Health: The Nigerian healthtech startup raised an impressive $30 million in a Series B funding round led by AXA Investment Managers. The funds will be directed towards expanding Helium Health’s software tools and financing solutions, with a specific emphasis on their fintech offering, HeliumCredit.

- Yellow: The transportation and logistics startup secured $14 million in a Series B funding round led by Convergence Partners. Yellow plans to strengthen its presence in existing markets and introduce digital and financial products to enhance its service offerings.

- In addition, lending platforms Fairmoney and Fast Credit secured $5.39 million and $3.6 million, respectively, through commercial paper issuance. This alternative funding avenue showcases the evolving financial landscape and the potential for startups to explore diverse funding mechanisms.

Pre-Seed Funding

The pre-seed funding rounds in June set a promising tone for African startups, with remarkable achievements:

- Messenger: Nigerian logistics platform Messenger secured an undisclosed pre-seed funding round led by Nama Ventures, Aidi Ventures, and notable angel investors. The capital infusion will provide Messenger with the necessary financial backing to support its growth and expansion plans, particularly in establishing a strong presence in the last mile logistics market in Africa.

- Talstack: Talstack, a Nigerian talent upskilling startup, raised $850,000 in a pre-seed funding round led by Ventures Platform, Voltron Capital, Golden Palm Investments, and TLcom Capital. This funding injection will enable Talstack to enhance its comprehensive upskilling platform, empowering businesses to cultivate a skilled workforce and drive economic growth.

- NewComma: Africa-focused social media platform NewComma successfully concluded a pre-seed funding round led by SFC Capital. The funding obtained will significantly accelerate NewComma’s technological development, allowing African and Black creatives to reshape the global creative industry and showcase their talent on a global stage.

- Agel: Egyptian startup Agel raised substantial pre-seed funding with participation from Plus Venture Capital, Seedstars, Flat6labs, and other investors. The raised funds will be deployed to support Agel’s pursuit of a non-banking financial institution license, refine its product offering, and expedite its expansion across Egypt’s evolving startup ecosystem.

Seed Funding

Seed funding rounds during June provided critical support to fuel the growth of various African startups, backed by impressive figures:

- Haul247: Nigerian logistics platform Haul247 raised $3 million in seed funding, led by the Umunthu Fund and Investment One. With this funding, Haul247 aims to expand its market share, targeting a 20% share and onboarding 50 multinationals onto its platform. The startup also plans to extend its operations to other African countries where it already has a presence, opening new avenues for growth and market penetration.

- Peach Cars: Kenyan automotive marketplace Peach Cars secured $5 million in seed funding led by the University of Tokyo Edge Capital Partners (UTEC). These funds will be allocated towards talent acquisition, enhancing research and development (R&D) endeavors, and advancing Peach Cars’ technological solutions. The startup aims to disrupt the automotive industry in Kenya and beyond, providing a seamless and efficient platform for buying and selling vehicles.

- Eze: Nigerian B2B electronic wholesalers marketplace Eze closed an oversubscribed seed round, raising $3.7 million. The funding round saw participation from renowned investors, including Y Combinator, Right Side Capital, C2 Ventures, and others. The raised capital will be utilized to enhance Eze’s platform and offer a comprehensive solution that effectively addresses the challenges faced by B2B traders, enabling smoother transactions and increased efficiency in the wholesale sector.

- Kubik: Ethiopian startup Kubik raised $3.34 million in a seed round led by Plug & Play, BESTSELLER Foundation, GIIG Africa Fund, and others. These funds will play a pivotal role in fueling Kubik’s expansion efforts as the company looks to scale its operations across Ethiopia. Kubik aims to revolutionize the e-commerce sector in Ethiopia by providing a user-friendly platform that connects buyers and sellers, unlocking new opportunities for businesses and consumers alike.

Series B Funding

Series B funding rounds in June brought substantial investments to support the expansion and development of African startups:

- Helium Health: Nigerian healthtech startup Helium Health raised an impressive $30 million in a Series B funding round led by AXA Investment Managers. The funding will be directed towards the expansion of Helium Health’s software tools and financing solutions, particularly focusing on HeliumCredit, the fintech offering provided by the startup. This investment will further strengthen Helium Health’s position in the healthcare sector, driving innovation and improving access to quality healthcare services.

- Yellow: Mobility startup Yellow secured $14 million in a Series B funding round led by Convergence Partners. The round also saw participation from Energy Entrepreneurs Growth Fund and Platform Investment Partners. With this fresh capital infusion, Yellow aims to strengthen its presence in existing markets, such as Malawi, Rwanda, Uganda, Zambia, and Madagascar. Furthermore, Yellow plans to introduce digital and financial products to enhance its service offerings and cater to the evolving needs of customers in the mobility space.

Diverse Funding Landscape and Key Trends:

The funding landscape in June showcased a diverse range of investment sectors and trends, reflecting the rich entrepreneurial ecosystem in Africa:

- Industry Focus: Investors demonstrated interest in various sectors, including logistics, talent upskilling, social media, automotive, fintech, healthtech, and more. This diversity signifies the vast potential for innovation and entrepreneurial endeavors across multiple industries in Africa.

- Support for Local Solutions: Funding rounds specifically aimed at empowering local startups to address regional challenges were prominent. Investors recognize the significance of supporting homegrown solutions tailored to African markets, fostering sustainable growth and development.

- Global Investor Participation: Prominent global investors participated in funding rounds, reflecting the increasing global recognition of Africa’s entrepreneurial potential. The involvement of renowned venture capital firms, angel investors, and impact investors signifies a growing appetite for African startups and the desire to be part of their success stories.

- Expansion and Technological Development: Funding received by startups will be channeled towards expansion efforts, market penetration, talent acquisition, R&D, and technological advancements. These investments will enable startups to scale their operations, refine their products, and enhance their technological infrastructure, ultimately driving innovation and positive impact.

The Impact of Early-Stage Programs and New VC Funds

The abundance of investments can be attributed to the announcements of two early-stage programs, The Baobab Network, and Black Founders Fund, unveiling their cohorts.

Additionally, the launch of three venture capital funds during this period further contributed to the surge in early-stage investment activities. These initiatives indicate a growing interest in supporting early-stage startups and nurturing their growth potential:

Managed by AfricInvest, the Transform Health Fund (THF) has successfully raised $50 million, with backing from the Health Finance Coalition (HFC). The THF is a blended-finance fund established to advance local-led health supply chains, care delivery systems, and digital solutions across Africa. Its core purpose is to provide financing to enterprises that enhance health system resilience and preparedness throughout the continent.

Avanz Capital Egypt is introducing two new funds as part of its strategy to diversify its offerings and provide targeted support to various sectors. The first fund, named the Avanz Manara Fund, will specifically cater to the needs of small and medium enterprises (SMEs) in Egypt. The second fund will focus on low-carbon projects and will operate under the name “EGYCOP.” As part of its operations, the fund will issue “carbon credits,” facilitating the recognition and trading of carbon reduction efforts.

Seedstars Capital and Fondation Botnar have collaborated to introduce the Seedstars Youth Wellbeing Venture Fund. With the objective of enhancing the well-being of young individuals in low- and middle-income countries across Africa, this initiative intends to invest $20 million in early-stage, purpose-driven companies. The fund will primarily be deployed in Tanzania, Ghana, Senegal, Morocco, and Egypt, supporting companies operating in or expanding to these regions.

Looking Ahead: The funding landscape for African startups in June showcased the resilience and potential of the continent’s entrepreneurial ecosystem. The surge in funding deals, fueled by early-stage investments, indicates a strong commitment to fostering innovation and supporting the growth of startups across diverse sectors. As the African startup landscape evolves, it will be crucial to monitor the trajectory of these trends and their impact on shaping the future of the continent’s entrepreneurial ecosystem.

The commitment of early-stage programs and the emergence of new venture capital funds further augur well for the growth and success of African startups, highlighting the opportunities that lie ahead.

In case you missed it:

Read all the AU-Startups Ecosystem Weekly Insider Issues for June 2023

Week 1: Issue #64: Sun King secures $130M in securitization deal, Zofi Cash raises $1M in pre-seed, and more

To discover promising African startups, check out AU-Startups Watchlist

Subscribe to stay tuned for next month’s edition as we continue to explore the latest funding trends, emerging ventures, and insights from the dynamic world of African entrepreneurship.