The implementation of the AfCFTA agreement aims to transform Africa into a consolidated market, providing easy access to trade for over 1.3 billion people across 55 nations on the continent with minimal restrictions. In essence, it hopes to transform Africa into the world’s largest free trade zone.

While this accomplishment is undeniably impressive, several technological startups are already laying the groundwork for this endeavor. These companies have successfully navigated national and regional boundaries to provide services in multiple markets across Africa.

These companies, led by visionary founders, are boldly expanding their operations into new environments, undeterred by regional or cultural differences.

In honor of Africa Day this year, we are highlighting startup companies and their founders who are shaping a new narrative through innovative solutions that transcend regional boundaries and have gained traction in multiple African markets.

- Chari

Chari is a YC-backed B2B ecommerce startup that digitizes financial processes and services for FMCG distributors in Africa. The company provides services that enable retailers to purchase inventory and have them delivered to their preferred locations without breaking a sweat.

The company was launched in Morocco in 2020 to enable ‘mom and pop’ store owners in local communities order products and have them delivered at their convenience. However, the company has since expanded into Tunisian and broken the regional barrier by finding its way into Ivory Coast in sub-saharan Africa.

- Figorr

Figorr, formerly known as Gricd, is an Internet of Things company that offers cold chain solutions for last-mile delivery of temperature-controlled products. They ensure that perishable agricultural outputs, vaccines, and other temperature-sensitive health care items such as insulin reach end users in optimal condition.

Figorr assists clients in avoiding losses due to a lack of visibility by providing vital information such as the location, humidity, and temperature conditions of perishable items. The company also works with insurance companies to provide easy access to insurance options for their clients, thereby helping to reduce risks.

One of Figorr’s key moments was when it assisted the Nigerian National Primary Health Care Development Agency in tracking over 40 million vaccine doses during the Covid 19 Vaccine rollout.

- Caantin

Caantin, formerly TopUp Mama, is an IT company that develops digital solutions to assist restaurant owners in managing, purchasing, and financing their inventory. Their vendor procurement management software, which acts as a direct channel between vendors, farmers, and food raw material distributors, enables restaurants to receive inventory remotely via digital technology.

The company currently serves over 4,300 restaurants in Nigeria and Kenya, including well-known food chains and hospitality services such as Kenya’s Sheraton Hotel.

- Kobo360

Kobo360 is a YC-backed e-logistics startup that connects African businesses and individuals to reliable, efficient, and cost-effective haulage and delivery services. Their digital infrastructure connects trucks and cargo owners, providing cost-effective logistics solutions by leveraging technology and existing infrastructure.

Since its inception in 2016, the company has expanded dramatically and now operates in multiple countries across Africa’s five major subregions.

- Grey

Grey is a YC-backed fintech startup that provides Africans with free and easy access to local and foreign currencies. The company operates a platform that allows users to open foreign bank accounts, exchange currencies instantly, and transfer money across borders without having to go through unnecessary red tape.

Although Grey was originally intended for Nigerians, it has quickly expanded into East African countries, with plans to expand further into North Africa.

- Payday

Payday is a startup that facilitates cross-border payments and transactions for Africans, primarily in East and West Africa. Payday’s technology-driven digital infrastructure enables quick and global payment options, allowing users to conduct cross-border transactions without being constrained by currency differences.

The startup was founded to simplify how Africans conduct international transactions, and it has consistently delivered on that promise over the years.

- Lori Systems

Lori Systems is a tech-focused logistics and supply chain startup that primarily functions as a network connecting freight carriers to cargo. It prides itself as an Africa first mover, seamlessly coordinating haulage across frontier markets in various parts of the continent. Lori operates in Kenya, Nigeria, Uganda, and other African countries.

Lori Systems was founded in 2016 to solve problems in the African Logistics industry by making the market more efficient and lowering the cost of moving freight across the continent.

- Peach Payments

Peach Payments is an IT solutions provider that offers digital options to help businesses receive payments from customers more efficiently. The company offers a consolidated payment toolkit that includes everything a business needs to accept, record, and disburse payments via web and mobile applications.

Rahul Jain and Andreas Demleitner founded Peach Payments in South Africa in 2012. Since then, it has become a household name in the financial services industry. To expand its user base and reach beyond the southern African region, the company has expanded into Kenya and Mauritius.

- Jumo

Jumo is an embedded fintech company providing technology that enables other businesses to offer financial services to their customers. The company leverages AI and predictive technology to provide progressive financial options to entrepreneurs and end clients.

Jumo began operations in South Africa in 2015, and has since grown rapidly and expanded beyond southern Africa. Jumo’s services are available in several markets in Southern, Western, and Eastern Africa, with the company currently serving over 10 million customers.

- Bizao

Bizao is a fintech company that helps entrepreneurs thrive by digitizing payment methods. The company offers a set of tools that allow businesses to accept payment via a variety of methods such as bank transfer, mobile money, and phone credit.

The company was established in 2019 and is headquartered in Tunis, Tunisia. However, it has since expanded into several parts of West Africa, including Senegal, the Ivory Coast, and Cameroon. Within four years of operation, the company has served over 200 million end users and assisted over 100 businesses in digitizing their payments.

- M-Kopa

M-Kopa is an asset financier with the goal of allowing underbanked Africans to own essential utilities. The company operates a connected asset financing platform that allows customers to obtain the funds they require to purchase life-enhancing products such as solar lighting, smartphones, and refrigerators.

Nick Hughes, Chad Larson, and Jesse Moore founded M-Kopa in 2012. The company is headquartered in Nairobi, but it has expanded beyond national and regional boundaries, entering markets in Nigeria, Ghana, and Uganda. M-Kopa has provided over $1 billion in credit to over 3 million customers, enabling them to purchase smartphones, solar power systems, and electric motorcycles, among other things.

- Ivorypay

Ivorypay is a blockchain-focused company that enables online and offline payments in Africa. The company operates an innovative digital platform that provides businesses with a suite of options for accepting payments in stable cryptocurrencies both locally and internationally. For businesses to receive payment from their customers, Ivorypay’s solution includes checkout buttons, QR codes, and payment links.

Ivorypay was established in 2022 and is based in South Africa. However, the company has expanded into West Africa, establishing a base of operations in Nigeria while also expanding into the Ghanaian and Kenyan economies. Ivorypay’s blockchain-based service is addressing the issue of high transaction costs for local and cross-border transactions.

- Paychant

Paychant is a crypto payments gateway provider that’s bridging crypto and fiat rails in Africa. The company operates a financial infrastructure that enables self-custodial wallets and dApps to seamlessly onboard and offboard users in Africa via traditional payment networks.

The company began operations in 2019 and in its first ten months, processed over 15,000 transactions for over 5000 users in Africa, particularly Nigeria. After establishing a strong foothold in Nigeria, the company has since expanded into East Africa, entering Kenya and Zambia. Paychant is currently working to expand its services to Francophone countries throughout Africa.

- BitMama

Bitmama is a crypto services company facilitating crypto-fiat exchange and conversion in Africa. Bitmama operates a digital exchange platform where users can trade their crypto assets for fiat currency or vice versa. Essentially, Bitmama makes it easy for Africans to purchase Bitcoin, Ethereum, Celo, and other digital assets.

BitMama launched in 2016 in 2016 as a crypto P2P initiative operating on a Whatsapp group. The company quickly expanded and launched its digital infrastructure, which included a formalized exchange platform for cryptocurrency merchants to trade assets. Bitmama’s services are currently available to users in several African countries. In addition, the company has launched changera, a social payment solution that allows users to pay for subscriptions and bills with stablecoins.

- Bitnob

Bitnob is a crypto-fintech service provider incorporating traditional financial services into cryptocurrency utilities. Users can save bitcoin and fiat currency in the company’s crypto bank. They can also send, receive, borrow, and earn Bitcoin securely and easily on the platform.

Bitnob primarily serves the Nigerian market, but the nature of its services allows it to be accessed by users worldwide. As a result, Bitnob’s digital platform is easily accessible to users in Ghana, Kenya, and Nigeria. The company’s goal is to make it simple for every African to connect and use blockchain technology for their financial needs.

- Zone

Zone, formerly Appzone, is a payment infrastructure that uses blockchain technology to provide banking as a service to African organizations. Zone works with banks and financial institutions, providing a blockchain network to process all ATM transactions.

Zone is essentially adapting blockchain technology, which has previously been associated with cryptocurrency, for fiat currency transactions. Zone also enables cross-border trade using stablecoins between end users in several African countries and regions. Zone is now accepting payments in Nigeria, Ghana, and Zambia. Since rebranding, the company has grown tremendously, processing over $1 million in daily transaction volume.

- Quidax

With its user-friendly platform, Quidax enables individuals to engage in a wide range of crypto-related services, including sending, receiving, storing, purchasing, and selling digital currencies. Beyond serving individual users, Quidax also empowers fintech companies to offer crypto-related services to their customers, fostering technological advancement and financial inclusion.

Since its establishment in 2018, Quidax has been at the forefront of expanding the scope of cryptocurrency transactions in Africa. With its operational base in Nigeria, Quidax caters to users from across the continent, promoting accessibility and convenience. By bridging the gap between traditional finance and the world of cryptocurrencies, Quidax is driving the adoption of digital currencies and empowering individuals and businesses in Africa to participate in the global crypto economy.

- TradeDepot

By leveraging Trade Depot’s services, retailers and distributors can enhance supply chain efficiency, inventory management, and overall operational effectiveness. Trade Depot offers a comprehensive suite of tools and services, enabling businesses to efficiently manage their inventory, place orders, track deliveries, and gain valuable real-time market insights.

While Trade Depot’s primary operational base is in Nigeria, the company is actively expanding its presence beyond the country’s borders. By establishing operational bases in other African countries, Trade Depot aims to cater to the diverse needs of businesses across the continent, fostering growth and streamlining operations for a wide range of businesses.

- Jetstream Africa

By connecting businesses with a reliable network of carriers and freight forwarders through its platform, Jetstream Africa is redefining how logistics operations are managed. With a focus on optimizing supply chains and streamlining logistics processes, Jetstream Africa empowers businesses to enhance their operations and drive efficiency.

The startup has strategically located operational bases, allowing it to effectively serve businesses in different regions across the continent. Jetstream Africa is paving the way for a more interconnected and efficient logistics landscape in Africa, unlocking new opportunities for businesses and facilitating economic growth throughout the continent.

- Klasha

Klasha is a tech company that redefines international payments for companies selling goods to Africans. The company develops payables and receivables solutions for businesses and consumers, enabling smooth payment movement between Africa and other continents. Klasha facilitates seamless scaling into Africa for global businesses through its payment technology, utilizing traditional payment methods.

Klasha currently operates in Nigeria, Uganda, South Africa, Zambia, and Tanzania. Over the years, Klasha has processed hundreds of thousands of transactions and continues to grow, with plans for further expansion into many other African countries.

- Yobante Express

Embracing the gig economy and independent couriers, Yobante Express operates a dynamic network of relay points to efficiently transport cargo from one point to another until reaching its final destination. The company’s reliable and user-friendly platform plays a vital role in facilitating this seamless process.

With Yobante Express, customers benefit from real-time tracking and notifications, ensuring full visibility of their shipments throughout the journey. The platform also offers convenient online booking options, allowing users to easily schedule and manage deliveries. Additionally, Yobante Express excels in efficient package handling, guaranteeing that items are cared for and delivered promptly.

- Swiftly

Swiftly‘s platform allows businesses to easily compare price quotes from a vast network of trusted carriers and freight forwarders. This empowers businesses to make informed decisions and choose the best logistics options for their needs. One of Swiftly’s key strengths lies in its provision of expert customs advice. Through its platform, businesses can access valuable insights and guidance to navigate the complexities of customs procedures, enhancing compliance and minimizing delays.

With strategically located bases, Swiftly ensures comprehensive coverage across multiple regions, catering to the diverse needs of businesses. The company has successfully expanded its services to markets in South Africa, Burkina Faso, Rwanda, Kenya, and Nigeria, solidifying its presence across the continent.

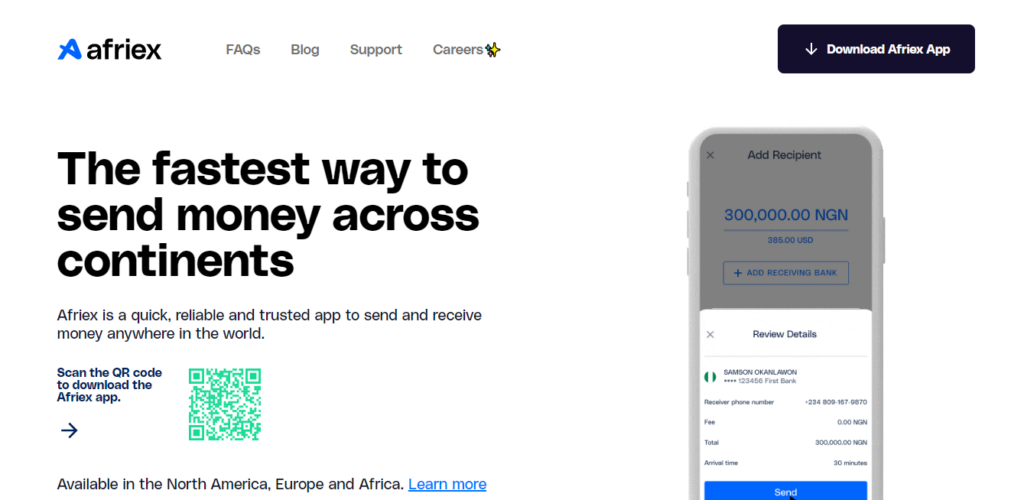

- Afriex

With a focus on financial inclusivity and efficiency, Afriex offers businesses a comprehensive suite of options to accept payments locally and internationally using stable cryptocurrencies. Headquartered in South Africa, Afriex has expanded its operations across multiple regions, including Nigeria, Ghana, and Kenya. By leveraging blockchain technology, Afriex is revolutionizing the way businesses transact, enabling secure and cost-effective cross-border payments.

The company is empowering businesses in Africa to embrace the benefits of crypto-centric payments, unlocking new opportunities for growth and financial accessibility. With a vision to enhance financial inclusivity, Afriex is paving the way for a more interconnected and efficient financial landscape across the continent.

- Dabchy

Dabchy is a Tunis-based fashion marketplace that connects buyers and sellers, specifically targeting women. The platform offers a unique opportunity for sellers to monetize their unused or pre-owned clothes and accessories, while buyers can enjoy discounted rates on fashionable items. This creates a mutually beneficial scenario for both parties involved.

Since its launch in 2016, Dabchy has expanded its operations into Morocco and Algeria, further broadening its reach within the region. The platform goes beyond being a marketplace by fostering a community-centered environment, allowing users to share their personal style, follow each other, and engage through likes and comments. In essence, Dabchy functions as a social network for fashion enthusiasts, where they can not only connect and express their fashion identities but also buy and sell items within the community.

- Kyshi

Through its digital platform, Kyshi offers accessible and efficient financial solutions for cross-border transactions. Utilizing a peer-to-peer system, users can create or accept offers at favorable rates, ensuring a seamless experience. With a commitment to expanding its reach, Kyshi currently facilitates cross-border transactions in multiple African countries, empowering individuals and businesses in the evolving global marketplace.

Driven by technology and innovation, the startup is reshaping the financial landscape, providing convenience and efficiency to users across the continent. With Kyshi, the future of cross-border financial services in Africa is being transformed, enabling economic growth and financial inclusion.

- Flutterwave

Flutterwave is a trailblazing fintech company that is driving transformation in the financial services landscape in Africa. Through its innovative payment gateway, Flutterwave enables businesses to accept payments seamlessly using diverse methods such as cards, mobile money, and bank transfers.

With a robust presence in the African market, Flutterwave has forged strategic partnerships with key financial institutions, payment providers, and businesses across the continent. By continually expanding its network and introducing new features, Flutterwave is reshaping the way individuals and businesses transact, fostering growth and efficiency throughout Africa and beyond.

- Paystack

With its powerful payment gateway, Paystack empowers businesses to accept online payments from customers across multiple channels, driving digital commerce across the continent. In addition to its payment gateway, Paystack provides businesses with valuable tools to efficiently manage their financial operations.

As an African fintech success story, Paystack has made a significant impact throughout the continent. By eliminating barriers to online payments and enabling businesses to flourish in the digital space, Paystack plays a vital role in fueling economic growth and fostering financial inclusion in Africa. With its innovative solutions and strong presence, Paystack continues to shape the future of payments in Africa.

- Cellulant

With its cutting-edge digital payment platform, Cellulant offers businesses a comprehensive range of services to seamlessly accept and manage payments. Their platform integrates multiple payment methods, including cards, mobile money, and bank transfers, catering to the diverse preferences of customers.

Cellulant’s extensive network of partnerships with financial institutions, mobile network operators, and businesses positions it as a leading player in the African fintech ecosystem. By harnessing the power of technology, Cellulant simplifies payments, empowering businesses and individuals alike. Through their innovative solutions, Cellulant is driving economic growth and fostering a more inclusive and accessible financial ecosystem across Africa.

- MVX

MVX connects freight service providers and cargo owners, streamlining the entire logistics chain. Additionally, the platform doubles as a digital freight booking system, offering cargo owners access to competitive deals for container transportation to any destination.

Initially focused on the Nigerian market, MVX has expanded its services to South Africa, Kenya, Ghana, and Rwanda. By combining fintech and trade expertise, MVX not only helps merchants find reliable carriers for their goods but also provides access to credit for payment of cargo transport and clearing.

- Terragon Group

Terragon Group is a leading technology company driving transformation in the digital marketing and data analytics landscape in Africa. Through its advanced digital marketing platform, Terragon Group empowers businesses to engage with their customers effectively, offering a comprehensive suite of tools and services such as personalized messaging, mobile advertising, social media management, and customer relationship management.

With a robust presence across the continent, Terragon Group has forged strategic partnerships with major brands and agencies, serving clients in Nigeria, Ghana, and South Africa. Their unwavering dedication to innovation, data-driven marketing, and technological excellence distinguishes them in the industry, positioning Terragon Group as a trusted leader in the digital marketing and data analytics space in Africa.

- Chipper Cash

Chipper Cash is a prominent fintech company that is driving digital payments and money transfers in Africa through its innovative solutions. With its user-friendly mobile application, Chipper Cash facilitates seamless and secure money transfers for individuals and businesses, both locally and internationally.

Through strategic partnerships with local banks and mobile money operators, Chipper Cash ensures widespread accessibility and convenience for its users. Currently operational in Nigeria, Uganda, Ghana, Rwanda, and South Africa, Chipper Cash is making a significant impact in enabling swift and hassle-free financial transactions across the continent.

- Moove

With a range of services including mobility financing, ride-hailing logistics, and mass transit, Moove is revolutionizing the way people access and experience transportation in six African countries and around the world.

By establishing a strong presence in Ghana, Nigeria, Kenya, and South Africa, Moove has become a trusted name in the African transportation industry. The company’s innovative solutions, emphasis on safety, and commitment to driver empowerment have solidified its reputation and positioned it as a key player in the evolving mobility landscape across the continent.

- Amitruck

Amitruck is a tech-enabled logistics service provider that is revolutionizing the logistics and supply chain market in Africa. With its user-friendly platform, Amitruck empowers businesses to streamline their logistics processes by connecting cargo owners with trucking logistics professionals.

Through a digital competitive bidding process, Amitruck brings trust and transparency to the African logistics sector, ensuring efficient and reliable service. By leveraging technology, Amitruck is transforming the way businesses manage their logistics operations, ultimately enhancing the overall efficiency and effectiveness of the supply chain in Africa.

- UzaPoint

Uzapoint is a pioneering platform that is reshaping access to essential services for businesses and consumers across different regions. With a range of banking and management solutions, Uzapoint simplifies corporate finance management for retailers and businesses.

Through its advanced technology and extensive network of service providers, Uzapoint offers a centralized and user-friendly solution, making it effortless for users to discover and access the services they require. By leveraging technology and streamlining the process, Uzapoint is transforming the way businesses and individuals connect with essential services, ultimately enhancing convenience and efficiency.

- Asoko Insight

Asoko Insight’s business information platform that is transforming the accessibility and analysis of data on African markets. With its user-friendly platform, Asoko Insight provides a comprehensive set of features and tools to enhance the business intelligence experience.

As a prominent player in the business information industry, Asoko Insight is committed to driving technological advancements and shaping the future of market intelligence in Africa. With operational bases in Nigeria, Egypt, Kenya, Rwanda, and other locations, Asoko Insight is well-positioned to serve the diverse needs of organizations across the continent, empowering them with valuable insights and data-driven decision-making capabilities.

- Baobab+

Baobab+ is an energy and technology company that is transforming access to clean and sustainable energy solutions in underserved communities. Through its platform, Baobab+ offers a wide range of energy products and services that cater to the diverse needs of communities.

From solar home systems and clean cooking solutions to productive use appliances and mobile payment options, Baobab+ provides affordable and sustainable energy solutions tailored to the specific requirements of users. By promoting clean energy and driving economic development, the company is making a significant impact in underserved communities. It currently serves consumers in multiple African countries, including Senegal, Mali, Ivory Coast, and Madagascar, further expanding its reach and positively influencing lives across the continent.

- Luno

Through its crypto exchange platform, Luno offers a seamless and feature-rich infrastructure for buying, selling, and storing cryptocurrencies.

At the forefront of the cryptocurrency industry, Luno provides comprehensive coverage and efficient services to users across various regions in Africa. By reshaping the landscape of digital currency exchanges, Luno empowers individuals and businesses to embrace the future of finance, unlocking the potential of cryptocurrencies for economic growth and financial inclusion.

- Speedaf

By harnessing the power of digital technology, Speedaf is transforming shipping and logistics, offering efficient and reliable solutions. The company collaborates with a vast network of delivery partners to enhance its operations and ensure seamless services.

With a strong presence in Nigeria, Egypt, and other African countries, Speedaf has established itself as a household name in the logistics and delivery industry. As an industry leader, Speedaf sets itself apart by prioritizing innovation and technology to simplify the transportation of packages and parcels. With its customer-centric approach and commitment to excellence, Speedaf is redefining logistics services in Africa.

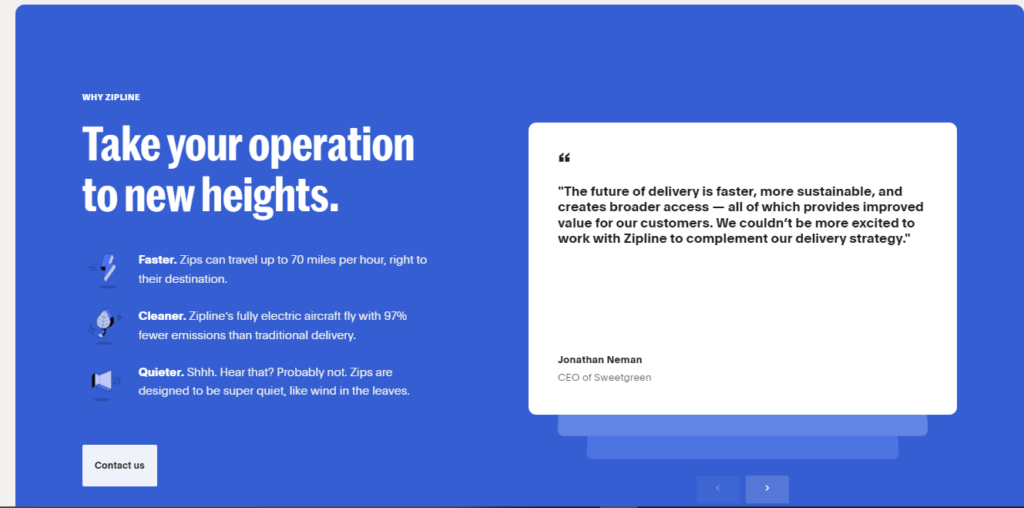

- Zipline

With its cutting-edge platform, Zipline employs autonomous drones to transport vital medical supplies to remote and underserved areas. Through a user-friendly web interface, healthcare workers can easily request and receive critical supplies, including blood products, vaccines, and medications, in a timely manner.

By harnessing the power of technology, Zipline addresses logistical challenges and ensures that healthcare providers can reach patients in even the most challenging locations. Zipline’s impact extends beyond Rwanda, as the company has expanded its operations to Ghana and beyond African borders. With its commitment to revolutionizing healthcare logistics, Zipline is playing a pivotal role in improving access to medical supplies and saving lives across the continent.

- Yellow Card

Yellow Card is a crypto-powered fintech company that simplifies financial transactions and payments through its wide range of features and tools. With Yellow Pay, a product that leverages bitcoin and USDT liquidity, users can process cross-border payments across 15 African countries, reducing both cost and time.

As a prominent player in the fintech industry, Yellow Card prioritizes convenience, security, and exceptional customer service. With its growing presence in Nigeria, South Africa, Kenya, Rwanda, Cameroon, and other African countries, Yellow Card empowers individuals and businesses to manage their finances efficiently and effectively.

- TradePass

Tradepass is a reputable platform that offers valuable business opportunities and growth prospects for both public and private enterprises on a global scale. By providing access to emerging markets worldwide, Tradepass creates impactful events that bring together individuals, products, and solutions, fostering unmatched business connections and networking opportunities.

Renowned as one of the most accredited event companies, Tradepass plays a pivotal role in supporting organizations to venture into new markets, expand their sales pipelines, secure prospects, raise capital, and find the right solution-providers. With a focus on facilitating deals, Tradepass is dedicated to uncovering agile and liquid growth markets, enabling comprehensive scalability and development. By connecting global business leaders, executives, and entrepreneurs, Tradepass empowers decision-makers to make informed and strategic choices that drive smarter business outcomes.

- Senditoo

Senditoo is an accessible platform that enables individuals to send instant mobile phone credit to friends or relatives abroad. With coverage in 140 countries and partnerships with over 400 mobile networks globally, Senditoo allows users to easily select recipients, make payments, and deliver credit directly to their phones in real-time.

As an international value remittance service, Senditoo serves diaspora communities by providing a convenient and cost-effective way to support family and friends in their home countries. With instant, low-cost, simple, and secure transactions, Senditoo offers one of the widest coverage options, reaching over 4.5 billion prepaid users worldwide. Whether it’s for individuals living or working abroad, Senditoo facilitates the instant transfer of airtime, ensuring a seamless connection with loved ones.

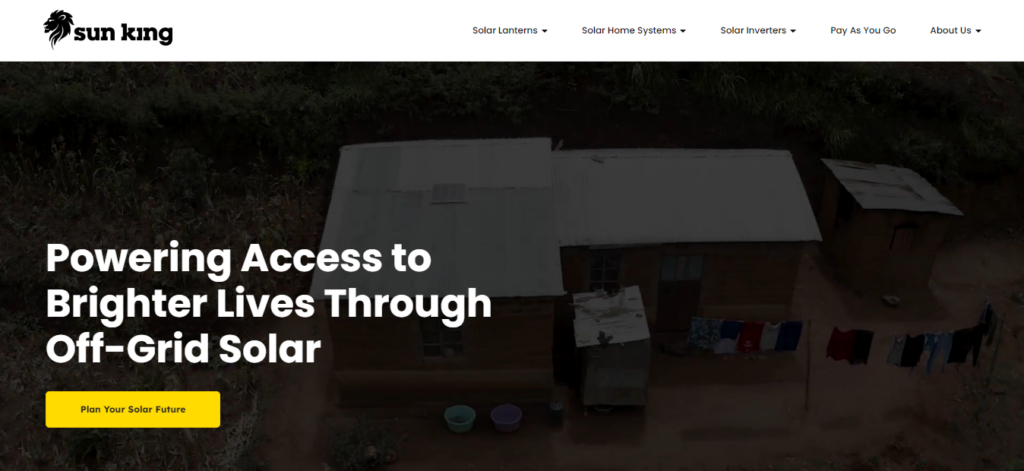

- Sun King

Sun King is a prominent solar company that operates in Africa and Asia, specializing in the design, distribution, installation, and financing of solar home energy products. The company offers a range of solar solutions, including solar home systems, inverter systems, and portable lanterns, catering to communities without reliable access to electricity. Sun King addresses the affordability challenge by providing pay-as-you-go financing options, making energy access more accessible for consumers.

Sun King employs innovative product design, affordable financing, and a grassroots installation approach to serve the approximately 1.8 billion people in Africa and Asia who lack reliable electricity access. The company collaborates with a network of international distribution partners to expand the off-grid market and has successfully sold its products in over 40 countries, including Kenya, Zambia, Uganda, Tanzania, and Nigeria.

- Sendy

Through Sendy’s platform, users can effortlessly request, track, and manage deliveries, streamlining their entire logistics process. With a strong focus on partnering with local drivers and businesses, Sendy demonstrates its dedication to promoting economic growth and empowering local communities.

Initially operating in Kenya, Sendy has expanded its services across East Africa and is steadily making its mark in West and North Africa through organic growth and strategic investments.

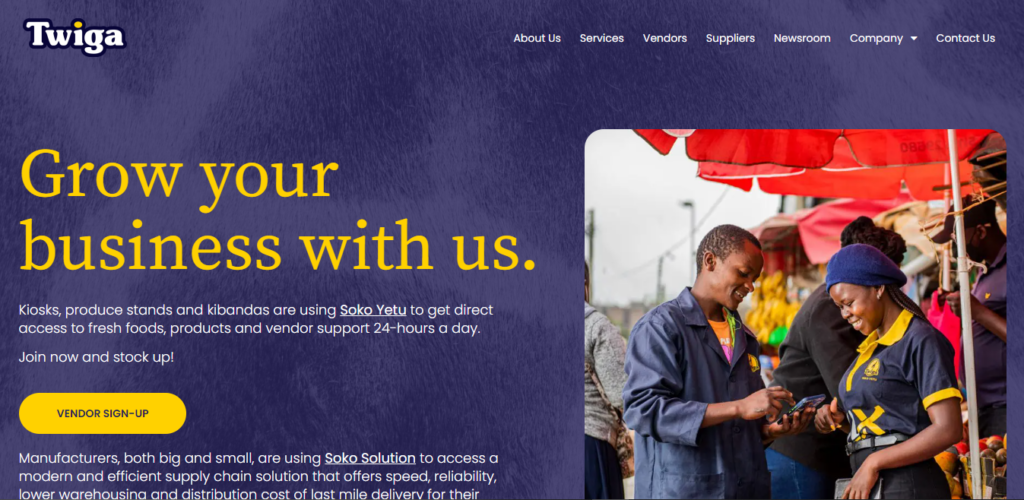

- Twiga Foods

Twiga Foods operates a highly efficient supply chain connecting farmers, suppliers, vendors, and customers within the African market. In addition to its core supply chain operations, Twiga has expanded its services to include financial and digital solutions for vendors and suppliers. This allows them to access the tools and resources they need to grow their businesses and improve supply chain efficiency.

Twiga has achieved remarkable growth since its inception, operating in Kenya and Uganda and serving over 140,000 customers. On a daily basis, the company supplies products to around 12,000 customers. To support its operations and ensure efficient delivery, Twiga employs a dedicated workforce of 3,000 people who work on last-mile operations, ensuring that products reach their destination in a timely manner.

- Jumia

Jumia is a Pan-African technology company that operates a marketplace, logistics service, and payment service. The company connects consumers with millions of products and services, offering convenience and competitive prices. Sellers benefit from Jumia’s platform as it provides them with a way to reach a wide customer base and grow their businesses.

With a logistics network consisting of warehouses and drop-off/pick-up stations across 11 African countries, Jumia ensures efficient delivery, even in remote areas. In addition to serving its own operations, Jumia’s logistics service is also available for third parties to leverage, enabling last-mile deliveries through its network. Through its payment service, JumiaPay, the company offers a secure and convenient solution for online transactions within its ecosystem. This further enhances the overall customer experience and supports seamless transactions on the platform.

- MFS Africa

MFS Africa is a pan-african fintech startup that operates the largest mobile money interoperability hub in Africa. With a presence in multiple African countries and the UK, MFS Africa connects mobile network operators through a single API, enabling seamless transactions and transfers between different mobile money systems.

One of the key services provided by MFS Africa is mobile remittance, allowing individuals to send and receive money across borders through their mobile wallets. The company’s API also facilitates merchant payments, bulk payments, bank-to-wallet transfers, and various other cross-border digital payment services.

- Tizeti

Tizeti is a fixed wireless broadband Internet service provider (ISP) in Africa, offering unlimited internet access to residential and small business customers. By utilizing wireless technology and solar-based infrastructure, Tizeti provides affordable and customer-friendly pricing for high-speed internet services.

Operating in several urban centers, across Nigeria and Ghana, Tizeti aims to bridge the digital divide by offering reliable and affordable internet connectivity in densely populated areas. In 2022, the company began collaborating with Eutelsat Communications, a leading satellite operator, to improve broadband penetration in Nigeria, particularly in underserved areas, thereby increasing access to reliable internet services throughout the country.

- Paga

Paga is a payments and financial services ecosystem in Africa that aims to eliminate the use of cash and improve access to financial services. It provides solutions for consumers and sellers to pay, get paid, and access financial services conveniently. Paga offers various channels for consumers to access and use money, including neighborhood stores and mobile phones. Sellers can also benefit from Paga’s services by selling more efficiently and accessing financing.

Similar to platforms like Square and PayPal, Paga’s ecosystem enables users to send and request money, pay bills, purchase airtime, and aggregate their financial accounts in one mobile app. It simplifies transactions and provides a unified platform for managing balances and conducting financial activities. After receiving regulatory approval from the National Bank of Ethiopia, the company expanded its services beyond Nigeria last year and has since partnered with the Bank of Abyssinia to launch its online payment gateway.

- Andela

Andela is a global talent network that connects leading companies with engineering talent in emerging markets. With a distributed organization spanning four continents, Andela helps companies scale their engineering teams efficiently. Companies such as GitHub, Cloudflare, and ViacomCBS rely on Andela to access top engineering talent quickly and cost-effectively.

At its core, Andela is a job placement network for software developers, focusing on sustainable careers and providing access to international roles and competitive compensation. Through the Andela Learning Community, technologists receive career coaching and support. Andela’s mission is to bridge the gap between distributed brilliance and unequal opportunity, connecting highly skilled global technology talent in emerging markets with meaningful opportunities. The platform serves as a bridge for companies to build sustainable, high-performing technology teams, and its talent community spans six continents.

- Branch

Branch is a fintech startup that leverages smartphone data to assess creditworthiness and provide access to credit. Through its mobile app, Branch uses machine learning algorithms and smartphone data such as text messages, call logs, contacts, and GPS to determine creditworthiness and approve loans within minutes. This approach enables the company to extend credit to individuals without a credit history or traditional bank account.

Branch’s mission is to make credit accessible anytime, anywhere, and the company operates in Kenya, Nigeria, Tanzania, Mexico, and India, serving over 3 million customers and issuing more than 15 million loans. With its innovative approach and expanding presence, Branch is revolutionizing access to credit for the middle class in emerging markets.

- Interswitch

Interswitch is a leading Africa-focused integrated digital payments and commerce company that played a crucial role in developing the Nigerian payments ecosystem. The company offers a comprehensive range of omni-channel payment solutions and operates throughout the payments value chain.

Since its establishment in 2002, Interswitch has evolved from a transaction switching and electronic payments processing company into a full-fledged payment services provider. With a significant presence in Africa, Interswitch manages payment infrastructure, delivers innovative payment products, and offers transactional services.

- Wasoko

Wasoko is a platform that enables retailers in Kenya, Tanzania, Rwanda, Uganda, Ivory Coast, and Senegal to conveniently order products from suppliers using SMS or its mobile app. Headquartered in Nairobi, Wasoko aims to reduce expenses for shop owners and provide employment opportunities for its sales agents.

The company ensures same-day delivery to stores and shops through a network of logistics drivers. Additionally, Wasoko offers a buy now, pay later option, providing working capital for retailers to purchase more goods. The platform plays a crucial role in ensuring affordable access to health, sanitation, and consumer household products for low-income communities, contributing to healthier and more productive lives across the regions it operates.

- Norebase

Norebase is a trade tech platform that simplifies the process of registering and incorporating companies for founders and businesses. The company offers online company incorporation, trademark registration, and corporate bank account opening services in various African markets.

Founded In 2021, Norebase successfully raised $1 million in pre-seed funding, with leading investors such as Samurai Incubate and Consonance Investment co-leading the funding round in 2022.