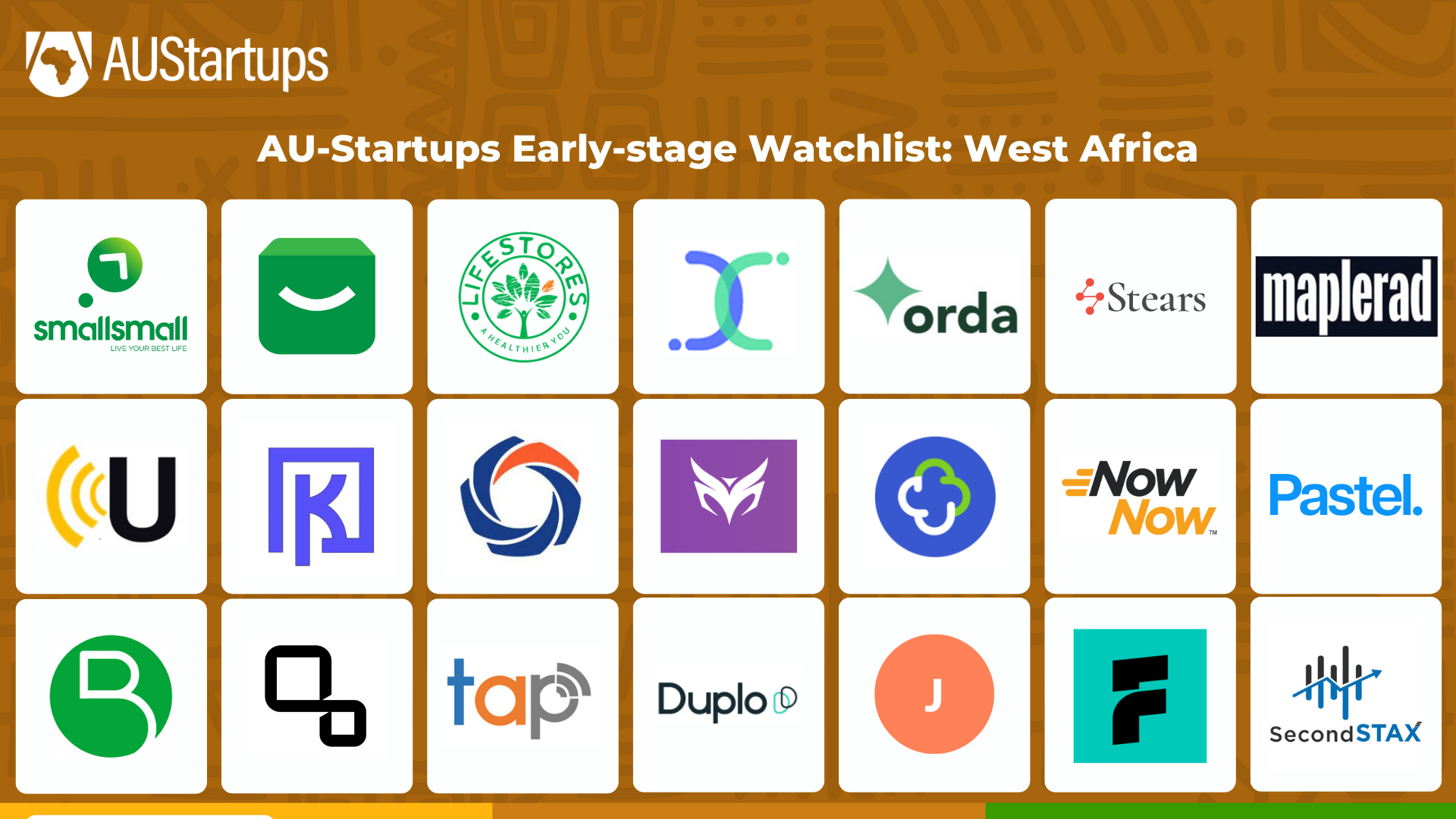

West Africa has a long history of producing the majority of Africa’s tech unicorns, currently accounting for six of the seven total. Andela is the lone outlier among them, with a disproportionate number of them being fintech startups.

However, startups from other industries are gaining traction. We’ve compiled a list of early-stage startups in the region to keep an eye on.

SmallSmall

SmallSmall offers tenants the convenience of monthly rent payments as well as the relief of not having to deal with real estate agents, while also offering landlords a way to screen tenants, increase their income, and manage properties.

In November 2022, the proptech startup raised a $3 million seed round led by Techstars.

Bumpa

Bumpa helps businesses manage inventory, engage customers, and track sales. It also includes social commerce solutions for Africa’s growing number of SMEs in need of digital solutions.

In October 2022, the startup raised $4 million in seed funding led by October Plug & Play and SHL Capital.

Lifestores Healthcare

Lifestores Healthcare is a retail pharmacy start-up that is using technology to democratize access to high-quality, low-cost primary care in Africa.

Last October, Health54 and Aruwa Capital invested $3 million in the healthtech startup’s Pre-Series A round.

Spleet

Spleet allows tenants to rent properties and pay monthly rent, while landlords can receive rent on a yearly basis.

MaC Venture Capital led a $2.6 million seed funding round for the proptech startup.

Orda

With little to no internet access, restaurants can manage dine-in orders as well as sales from other channels using Orda‘s solution.

Last November, Quona Capital and Fintech Collective invested $3.4 million in the foodtech startup.

Stears

Stears is an intelligence firm that offers global businesses and professionals subscription-based data and insight on Africa.

MaC Venture Capital led a $3.3 million seed round for the data intelligence firm.

Maplerad

Maplerad is a finance product that allows users to receive, hold, and make payments in multiple currencies, as well as create virtual and physical cards and pay bills.

Last October, the fintech startup raised $6 million in a seed round led by Valar Ventures.

Ubenwa

Ubenwa is a pioneer in the development of an automated sound-based diagnostic solution for infants, leveraging cutting-edge AI and years of scientific research.

In July 2022, the healthtech AI startup received a $2.5 million pre-seed investment from Radical Ventures.

Kippa

Kippa provides a suite of financial services that allow small-business owners to legally incorporate their companies, open bank accounts, receive and send payments, create online web stores, and manage their entire operation from a single platform.

Goodwater Capital and seven other investors recently contributed $8.4 million to the startup’s seed round.

Omnibiz

Omnibiz is a B2B e-commerce platform that connects manufacturers of fast-moving consumer goods (FMCGs) to retailers by digitizing supply chain stakeholders.

Timon Capital led a $15 million pre-Series A round for the ecommerce platform.

Metaverse Magna

Metaverse Magna publishes mobile games in emerging markets and builds developer tools to help game developers take advantage of new business models in web3 gaming. It functions as a independent entity within the Nestcoin ecosystem.

Last September, Wemade led a $3.2 million seed round for the blockchain gaming platform.

Remedial Health

Remedial Health offers digital procurement and PMR (patient medication records) platforms, allowing healthcare providers to source authentic pharmaceutical products from major manufacturers and distributors and receive them within 24 hours via Remedial Health’s logistics network. The company also offers financing to pharmacies and PPMVs for inventory purchases, as well as loans and salary advances to employees.

Global Ventures recently invested $4.4 million in the healthtech startup.

NowNow

NowNow‘s flagship product offers Nigerians financial services such as sending and receiving money and paying bills via a large network of agents located throughout the country.

In September 2022, the fintech startup raised $13 million in a seed round led by NeoVision Ventures.

Pastel

Sabi, Pastel‘s flagship product, is a digital bookkeeping app that allows small businesses to monitor and manage their transactions and customers, gain insights into their cashflows, issue receipts, and manage customers who owe them effectively.

In August of last year, the bookkeeping and accounting startup raised $5.5 million in a seed round led by TLcom Capital Partners.

BitMama

Customers use the Bitmama exchange to trade several cryptocurrencies, use their debit cards for standard online payments, pay utilities, and perform transactions such as staking to hedge against currency depreciation. It also offers a social payment platform called Changera, which allows non-crypto users to send and receive money from anywhere in the world.

In September last year, the blockchain startup raised a $2 million pre-seed round led by Launch Africa.

Anchor

Using its APIs, dashboards, and tools, Anchor assists developers in embedding and building banking products such as bank accounts, funds transfers, savings products, issuing cards, and offering loans.

In August 2022, the fintech startup received $1 million in seed funding from Byld Ventures and Y Combinator.

Touch and Pay Technologies

Touch and Pay offers a variety of near field communication (NFC)-based payment solutions for micro-transactions, such as the Cowry card, which enables users to make contactless public transportation fare payments.

Last September, the NFC-enabled fintech raised $3 million in a seed round from an undisclosed investor.

Duplo

Duplo offers an end-to-end solution for finance teams, assisting in the automation of back-office processes such as invoice generation and processing, bill receipt and approval, fund collection and disbursement, and account reconciliation.

In August last year, the fintech startup raised $4.3 million in a seed funding round led by Oui Capital.

Julaya

By digitizing payments to employees and suppliers instead of relying on cash, Julaya‘s platform enables businesses to streamline their accounting and improve operational efficiency. The company facilitates payments to mobile money and mobile banking wallets for African businesses and institutions. It accomplishes this by collaborating with telecom operators and other regional fintech startups.

Speedinvest invested $5 million in the Ivorian fintech startup in September 2022.

Farmerline

Farmerline provides smallholder farmers and agribusinesses with farm management tools such as field mapping, supply chain management, and remote tracking and identification of food sources.In September of last year, the agtech received $1.5 million in Pre-Series A funding from Oikocredit.

SecondSTAX

SecondSTAX is a tech-driven platform designed to make intra-continental equity trading easier. It allows its users to trade debt and equity securities on other African bond and stock exchanges. The company is developing Africa’s first cross-border capital markets order management portal.

LoftyInc Capital and two other investors contributed $1.6 million to the trading platform’s pre-seed round last September.