Western and Southern Africa usually dominate discussions involving fintech startup activities in Africa. That’s because many of the biggest hitters in the industry began their operations in these regions and more are coming up with groundbreaking innovative solutions and technology. However, that doesn’t relegate Northern Africa to mediocrity with regards to indigenous fintech startups proliferation.

The North African countries of Egypt, Morocco, Tunisia, and Algeria have all produced creators and innovators leveraging technology to provide a suite of financial services and benefits to North Africans. Here we discuss 15 of such fintech startups coming out of North Africa.

Khazna

Year Founded: 2019

Location: Giza, Egypt

Khazna is a fintech company enabling financial inclusion for unbanked business owners and consumers across North Africa. It primarily operates a point-of-sale financing solution that enables users to purchase items on credit and pay in monthly installments.

Khazna offers its services through a digital wallet which it describes as a financial super app. This infrastructure allows users to execute everyday financial transactions such as cash withdrawals, bill payments, and money transfers.

Its digital wallet is accessible via mobile devices and a web-based application on desktop devices.

Since its launch, Khazna has continually expanded its operations intending to reach 20 million unbanked North Africans. Towards this, it has secured investments and capital in multiple funding rounds and it has utilized the funds to widen its coverage.

Telda

Year Founded: 2021

Location: Cairo, Egypt

Telda is a fintech company that simplifies everyday transactions for users through its various financial products. It offers a variety of payment solutions to individuals and businesses, including money transfers, merchant payments, and bill payments.

Telda describes itself as a financial brand for Millennials and Gen Z with the mission of “removing the pain from peer-to-peer payments.” The company consolidates its products on an app-based wallet for mobile devices, allowing users to conduct financial transactions while on the go.

Telda’s solution is notable for its biometric authentication technology, which provides high-level security for users’ assets. But in addition to that, it also provides free cards for users which they can use for offline transactions.

Telda is continually improving its offerings to better serve customers locally and globally. Unsurprisingly, its digital solution has received positive feedback from users across North Africa.

MNT-Halan

Year Founded: 2018

Location: Giza, Egypt

MNT-Halan is one of the fastest-growing fintech and e-commerce ecosystems in North Africa. The company primarily targets unbanked consumers and businesses, providing them with easy access to digital financial services and encouraging the use of electronic banking solutions.

MNT-Halan operates a digital wallet that connects consumers, micro-enterprises, and merchants to a host of services including payments, BNPL options, e-commerce offerings, consumer finance, and business loans.

MNT-Halan has obtained micro, consumer, and nano finance licenses from the Financial Regulatory Authority enabling it to provide services to both businesses and consumers across Egypt.

The company recently raised $400 million in equity and debt financing which it plans to use in expanding its operations internationally.

Xpay

Year Founded: 2018

Location: Cairo, Egypt

Xpay is a pro-financial empowerment company using technology to drive transformations in the North African financial ecosystem. The company provides a range of solutions designed to improve the quality of life of users.

Primarily, Xpay provides financial management services for businesses and individuals, helping them make better money decisions. Its services are designed to give users full control over how they plan and manage their finances.

Using Xpay’s solutions, businesses can easily bill, track, and receive payments. The payment infrastructure incorporates several options that make it suitable for any type of payment including membership fees, service charges, or ticket fares. Individual users can also do all forms of cashless transactions on the platform.

Paymee

Year Founded: 2020

Location: Tunis, Tunisia

Paymee is a financial service enabler transforming how businesses receive money. It provides digital solutions that enable companies to receive payments and offer digital financial services to customers without any hassle.

Paymee’s primary product is an integrated digital payment gateway for web and mobile applications. Business owners can easily embed Paymee’s payment infrastructure into their digital storefronts to simplify payment processes for customers.

Staying true to its financial inclusion mandate, Paymee also provides solutions for businesses that don’t own digital storefronts. They enable businesses in this category to receive payment through special payment links while enabling physical stores to receive card payments through QR codes.

Paymee currently serves 550+ companies across 12 sectors and has facilitated over 350,000 transactions. The company is also actively expanding its operation to reach more businesses and widen its user base.

Blnk

Year Founded: 2020

Location: Giza, Egypt

Blnk is promoting financial inclusion and better standards of living for consumers in North Africa through its simplified credit service. It helps consumers purchase commodities they need when they can’t afford the full amount immediately.

Blnk operates a digital lending platform through which it provides point-of-sale financing to shoppers, letting them instantly receive credits to make purchases. Blnk’s solution is helping consumers circumvent low credit access and challenges associated with a lack of purchasing power; essentially fostering financial inclusion for Egyptians.

Over the years, the company has accelerated its services and expanded its reach while raising over $32 million through multiple funding rounds.

FlapKap

Year Founded: 2021

Location; Cairo, Egypt

FlapKap is a credit finance company helping emerging e-commerce businesses scale their operations and overcome growth challenges. It aims to eliminate the financial roadblock many upcoming digital storefronts face in a rapidly growing MENA ecommerce market.

FlapKap provides a revenue-based finance solution giving businesses the flexibility to access working capital facilities and pay back only when they generate revenue. The company also guides its clients on revenue maximization and advertising expenditure.

FlapKap also integrates AI-based insights and financial data analytics with ecommerce SaaS providers. As a result, the company is in partnership with Shopify, WooCommerce, Google, and Facebook. Primarily, FlapKap is positioning itself as a value-added services provider and growth partner for its clients.

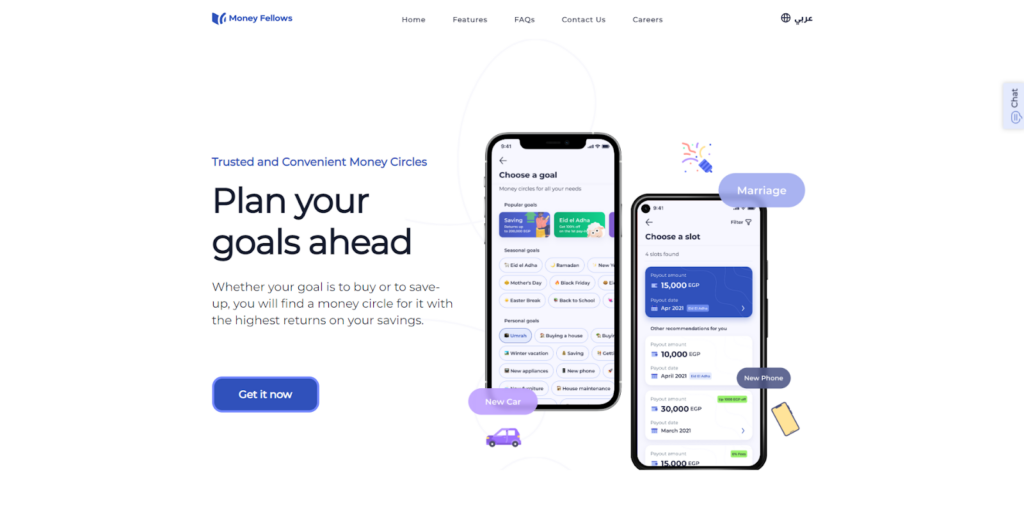

MoneyFellows

Year Founded: 2018

Location: Egypt

MoneyFellows is a Fintech company digitizing collaborative lending and savings for traditional Rotating Savings and Credit Associations. The company aims to help users meet their financial and savings goals through its digitized ROSCA model.

MoneyFellows combines savings and credit through a virtual money circle scheme. The company’s model operates on a premise involving a group of people contributing a specific amount monthly for a specific period and each participant gets to receive the total monthly contribution on a rotational basis. Essentially, participants save together in a pool and take turns to receive the total savings.

Aside from digitizing the ROSCAs, they also incentivize the scheme for participants by incorporating traditional credit and investment benefits. Through Money Fellows’ digital solution, participants can borrow i.e opt for early spots in the rotation and pay back with interest through the rest of the cycle. Or they can save, i.e choose the ending spots in the cycle and earn interest plus their return.

MoneyFellows has over 4.5 million registered users on its platform and currently serves users in Egypt with plans to expand across Africa.

Thndr

Year Founded: 2020

Location: Cairo, Egypt

Thndr is a YC-backed fintech company simplifying investments and making it easy for people to access financial instruments in the MENA region. The company seeks to increase investment penetration in North Africa by making investors out of regular people.

Thndr operates a digital platform that gives users the tools they need to open and manage investment accounts. The platform incorporates features like zero minimum deposit, zero commission trades, and other utilities designed to make account setup and funding easy for users.

In addition, the company facilitates access to tools and resources such as market data and real-time news that enable investors to make educated financial decisions.

Thanks to its exploits in promoting investment in MENA, the company has been dubbed Robinhood for Egypt and the Middle East, recreating the success of the US-based investment company. Thndr is currently diversifying its portfolio to enable users to access more securities in international markets.

Nexta

Year Founded: 2021

Location: Cairo, Egypt

Nexta is a neobank providing easy banking solutions for users. The company leverages digital technology to provide businesses and consumers with banking services tailored to their specific needs.

Nexta operates a digital platform that allows users to easily do money transfers, pay for services, and track and manage their expenses.

The company also makes it possible for users to aggregate multiple payment cards into one. I.e with a single Nexta card users can access all the financial services they previously needed multiple cards for.

Nexta prides itself on making money tasks simple, fast, and affordable for users. Spurred by the desire to reinvent payments, it is streamlining money management for Africans. As such, it has secured capital through multiple funding rounds which it is using to improve and expand its operations.

Paynas

Year Founded: 2019

Location: Cairo, Egypt

Paynas is a fintech and HR service provider transforming how employers manage, compensate, and ensure the well-being of their employees. The company provides HR departments with tools to effectively manage employees’ payroll accounting.

Paynas’s digital solutions include a traditional HR and Payroll management infrastructure that enables HR personnel to track employee attendance, manage leaves and vacations, and handle wage disbursement from a simple interface.

Paynas also partners with key players in the market to provide a variety of additional services. For example, it partnered with Visa International to create and issue Visa-powered Paynas Cards which offer employees access to a suite of financial services such as payments, BNPL, and salary advance.

The company also partnered with Libano-Suisse, a leading insurance provider to give users access to health insurance packages on its digital infrastructure.

Paynas is providing real employee management solutions to companies, helping them to circumvent challenges around employee satisfaction and wellness.

NowPay

Year Founded: 2018

Location: Cairo, Egypt

Nowpay is a YC-backed fintech company driving financial wellness for corporate employees. Nowpay aims to address the financial challenges salary earners face while waiting for their remunerations.

The company enables organizations to provide flexible remuneration options for their employees, allowing them to access their salaries whenever they need them. Essentially, Nowpay allows corporate workers access to salary advance, instant bill payment, cross-team money transfer, and credit shopping.

Nowpay partners with several notable companies including Kellogg’s, Lafarge, Mcdonald’s, and Trella processing over $1.5B monthly payments.

Gwala

Year Founded: 2022

Location: Casablanca, Morocco

Gwala is a financial services provider helping companies improve employee productivity through its financial wellness solutions. The company provides flexible wage access to employees, enabling them to get funds whenever they need it without necessarily waiting for the next payslip from their employers.

Gwala’s financial services include real-time wage access for corporate workers which it offers through a digital platform. Organizations can also integrate Gwala’s solutions into their payroll system to offer flexible payment options to their employees thereby keeping employee satisfaction and productivity high.

Gwala is a leading financial innovator in Morocco empowering Moroccans with the resources they need to attain financial freedom. The company recently raised capital in a pre-seed funding round which it intends to use to increase its reach.

Waffarx

Year Founded: 2017

Location: Cairo, Egypt

Waffarx is a consumer savings-oriented, IT solutions provider. The company is revolutionizing shopping experiences for consumers through its cash-back aggregator which happens to be the first of its kind in the MENA region.

Waffarx leverages technology to connect shoppers with cash-back offers and amazing deals from global and local brands. Primarily, the company enables customers to earn on their shopping experiences using commission-based models. And of course, they can use the money to buy more goods; essentially letting them save money on additional purchases.

Paymob

Year Founded: 2015

Location: Cairo, Egypt

PayMob is an infrastructure technology enabler facilitating the proliferation of digital financial services providers across the MENA region. The company provides a suite of financial technology solutions and embedded systems for direct-to-business and direct-to-customer fintech companies and neobanks.

Paymob offers a payment gateway for businesses to set up their online and offline payment methods. Primarily, Paymob powers transactions for businesses, serving them the technology to own and operate their digital financial solutions.

Paymob currently serves some of the biggest brands in the MENA region including Tabby, Uber, and Foodics. It has facilitated over 120 million transactions and boasts over 12 million users on all the financial services it deployed.