This week saw a flurry of activity, with two startups being acquired: gaming platform Galactech and valet service provider Go!TwentySix.

There were fifteen funding deals, including accelerator funding, with South African gaming mobile games publisher Carry1st’s $27M Pre-Series B deal being the largest.

Pre-Seed

Pakam, a Nigerian waste recycle management app, has raised $635,000 in pre-seed funding from undisclosed investors.

Adeleye Odebunmi and Wunmi Ogunde founded the company in 2021 with the goal of achieving waste scarcity through digital tools, while also developing a strong circular economy.

These funds will be used to improve the company’s ecosystem products and connect the dots in the ecosystem value chain.

Seed Extension

Kwara, a Kenyan fintech, has raised $3 million in a seed extension round from One Day Yes, Base Capital and Mikko Salovaara, CFO of Revolut. DOB Equity, Globivest, and Kobalt Music founder Willard Ahdritz were among the existing investors who participated in the extension round.

Founded in 2018 by Cynthia Wandia and David Hwan, Kwara helps traditional credit unions digitize their operations through its banking-as-a-service product.

The fintech intends to add more features to cater to the credit unions, as well as additional products for its neobank app users.

Pre-Series A

Flow, a South African prop-tech startup, has raised $4.5 million in a pre-Series A round led by Futuregrowth Asset Management, with participation from Endeavour Harvest Fund, Kalon Venture Partners, Vunani Fintech Fund, and Buffet Investments, as well as angel investors.

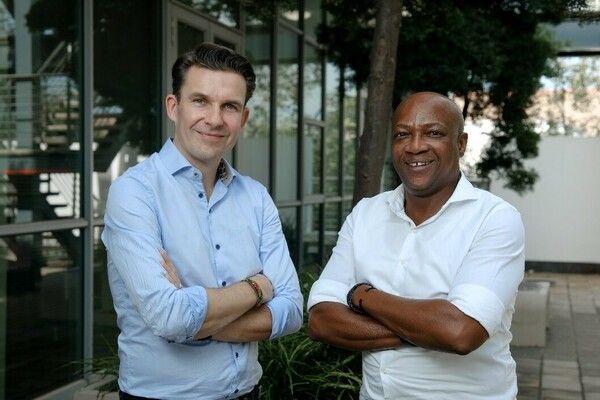

Flow, founded in 2019 by Daniel Levy and Gil Sperling, automatically creates and targets property ads for Real Estate Agencies and Property Developers, removing complexity and doing the heavy lifting while realtors close deals.

The capital raised will be used to fuel the company’s international expansion.

Pre-Series B

Carry1st, a South Africa-based mobile games publisher, has raised $27 million in a Pre-Series B round led by BITKRAFT Ventures with participation from Andreessen Horowitz (a16z), TTV Capital, Alumni Ventures, Lateral Capital, Kepple Ventures, and Konvoy.

Carry1st, founded in 2018 by Tinotenda Mundangepfupfu, Lucy Hoffman, and Cordel Robbin-Coker, is a social game and interactive content publisher that works with studios around the world to help them scale their games in dynamic, new markets across Africa.

The company plans to use the new funds to create, license, and publish new games, as well as expand Pay1st, the company’s monetisation-as-a-service solution.

Others

WeLight, a solar energy provider in Madagascar, has raised $20.5 million in funding from The European Investment Bank (EIB), Triodos Investment Management, and the EU’s Electrification Financing Initiative (EDFI).

The Madagascar-based electricity access provider, which is the result of a collaboration between Axian Group, Sagemcom, and the Norwegian Investment Fund for Developing Countries (NORFUND), will also receive €9 million from its stakeholders.

The investment will be used to fund a €28 million electrification project that will deploy solar mini-grids to power 120 settlements across the country.

Catalyst Fund has invested $2 million in ten African startups pioneering solutions in sectors such as agtech, insurtech, waste management, disaster response, and carbon finance, with the intention of assisting communities in adapting to the effects of climate change and building resilience.The startups will each receive $200,000, which includes $100,000 in equity investments and $100,000 in hands-on venture-building support.

The startups include Agro Supply, Assuraf, Bekia, Eight Medical, Farm to Feed, Farmz2U, Octavia Carbon, PaddyCover, Sand to Green, and VAIS. Three are from Nigeria, two from Kenya and Egypt, and one each from Uganda, Senegal, and Morocco.