Let’s round up the week by going through the funding data from across the African startup landscape in the second half of 2022; but this time viewing it through the lens of sector funding.

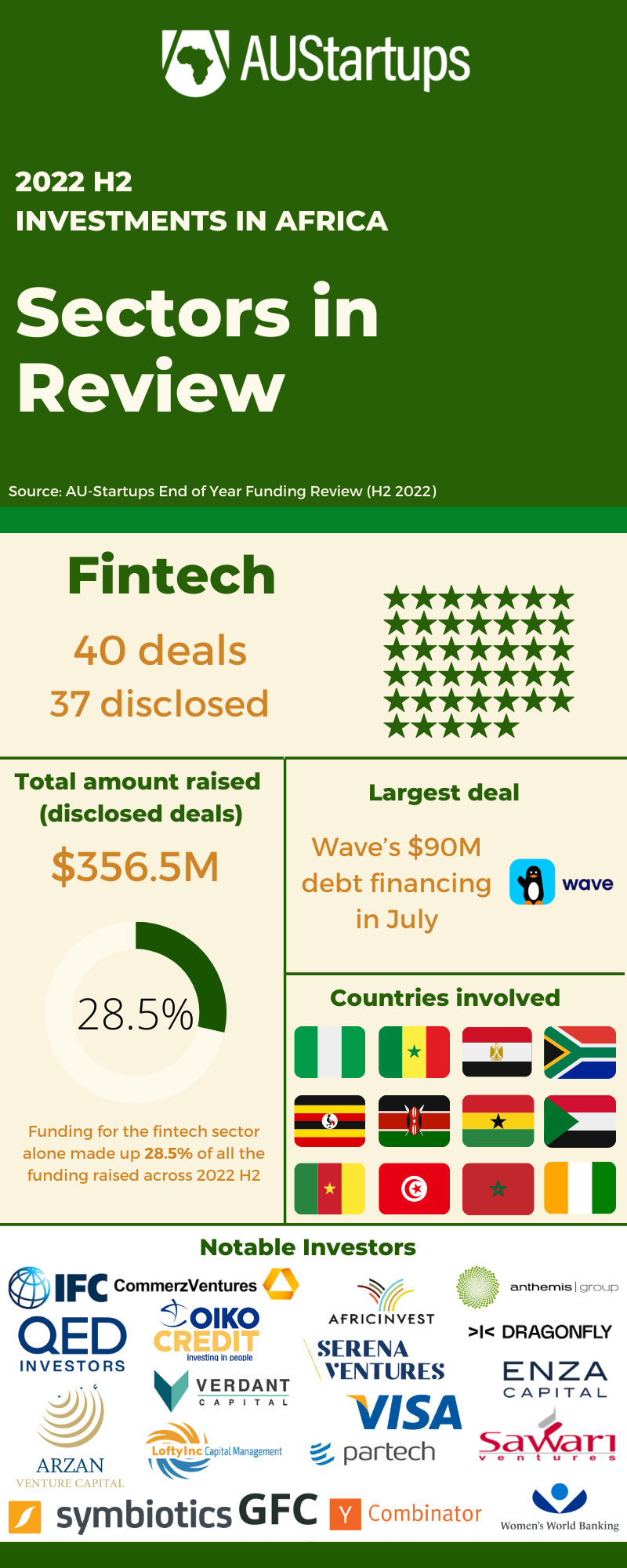

Fintech

In the fintech sector, for example, there were 40 deals in total, with 37 of them being disclosed. These deals raised a total of $356.543 million, with the largest deal being Wave’s $90 million debt financing in July. The countries involved in these deals include Senegal, Nigeria, Egypt, Ivory Coast, Uganda, Kenya, Ghana, Cameroon, Sudan, South Africa, Tunisia, and Morocco.

Notable investors in the fintech sector include IFC, QED, CommerzVentures, Arzan Venture Capital, Global Founders Capital, Partech Africa, Oikocredit, Enza Capital, Sawari Ventures, Serena Ventures, AfricInvest Group, Women’s World Banking Capital Partners, Symbiotics BV, Anthemis Group, Dragonfly Capital, Y Combinator, Visa, Verdant Capital and LoftyInc.

Logistics

In the logistics sector, there were 11 deals in total, with 8 of them being disclosed. These deals raised a cumulative $235.7 million, with the largest deal being Yassir’s $150 million Series B in November. The countries which saw investments in the logistics sector include Algeria, Nigeria, Kenya, Egypt, and South Africa.

Some of the notable investors in this sector include BOND, FEDA, Partech Africa, TLcom, 4Di Capital, CrossFund, Roselake Ventures, Mo Angels, Techstars, Launch Africa VC, 500 Global, Riyadh Angels, Flat6Labs, Skynet Worldwide Express, Google Africa Investment Fund and MOL PLUS.

E-commerce

E-commerce is another sector that has seen a lot of activity, with 21 deals taking place and a total of $165.97 million being raised. The largest deal in this sector was MaxAB’s $40 million Pre-Series B in October, and the countries involved include Egypt, Tanzania, Nigeria, Kenya, South Africa, and Morocco.

Some notable investors in the e-commerce sector include 4DX Ventures, Silver Lake, BII, DisruptAD, Flexcap Ventures, Outliers Ventures, Impact46, STV, Rise Capital, Timon Capital, Silicon Badia, Giant Ventures, Firstminute Capital, Raed Ventures, Nclude, Contact Factoring, Raya Trade & Distribution, Samurai Inc, The Venture Catalysts, Baseeta Investment Holdings and Endeavor Catalysts.

Other sectors

Cumulatively, other sectors saw a total of 71 deals, with a disclosed amount of $824.186 million being raised. The countries involved in these deals include Nigeria, Egypt, South Africa, Seychelles, Kenya, Mauritius, Rwanda, Tunisia, Ghana, Zimbabwe, Uganda, and Morocco.

These sectors include blockchain, mobility, energy, healthtech, agtech, proptech, foodtech, and edtech. We’d briefly examine each of them.

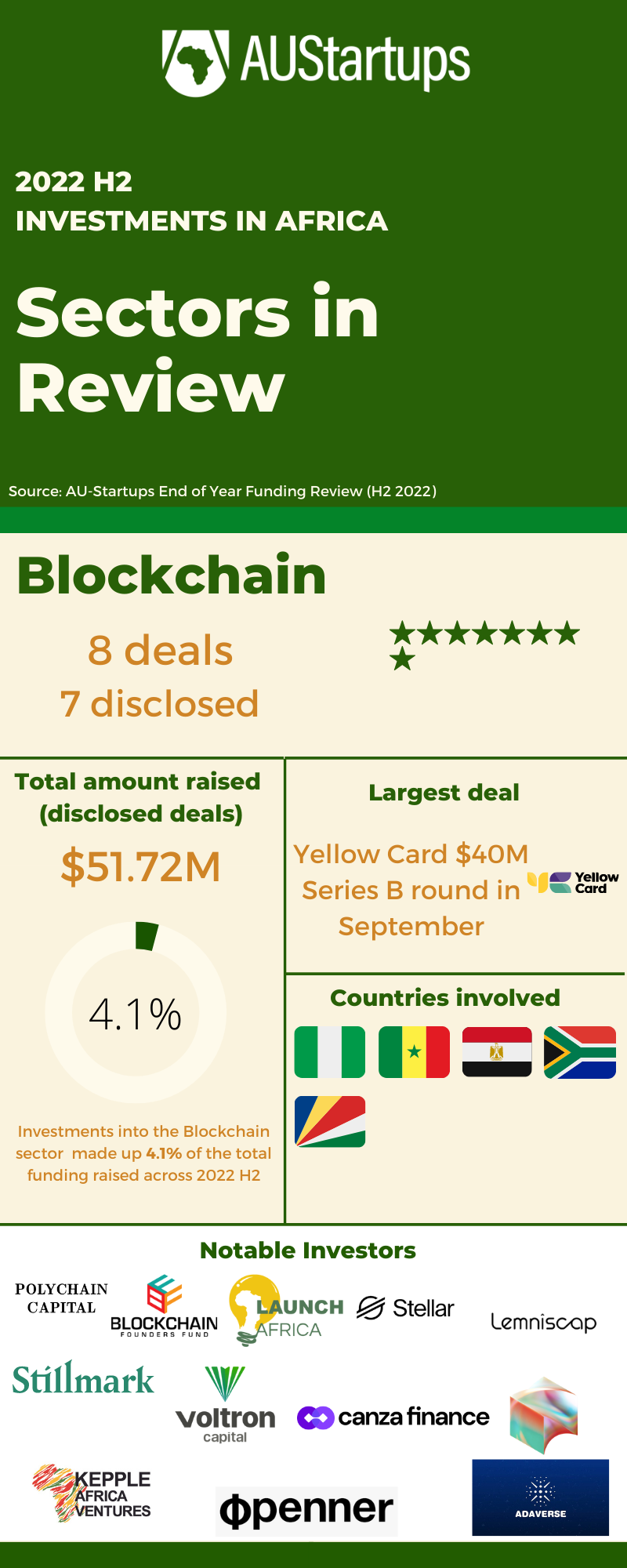

Blockchain

A total of eight deals were announced by startups involved in blockchain-related innovations, with only seven of them being fully disclosed. A total of $51.72 million was raised in disclosed funding, with Yellow Card’s $40 million Series B round in September being the largest single round recorded during the time period. Countries that saw investment in this sector include Nigeria, Egypt, South Africa, Seychelles and Kenya.

Some notable investors in this sector are Polychain Capital, Blockchain Founders Fund, Launch Africa, Stellar, Lemniscap, Stillmark, Block Inc., Adaverse, Nestcoin, Kepple Africa Ventures, Canza Finance, Openner and Voltron Capital.

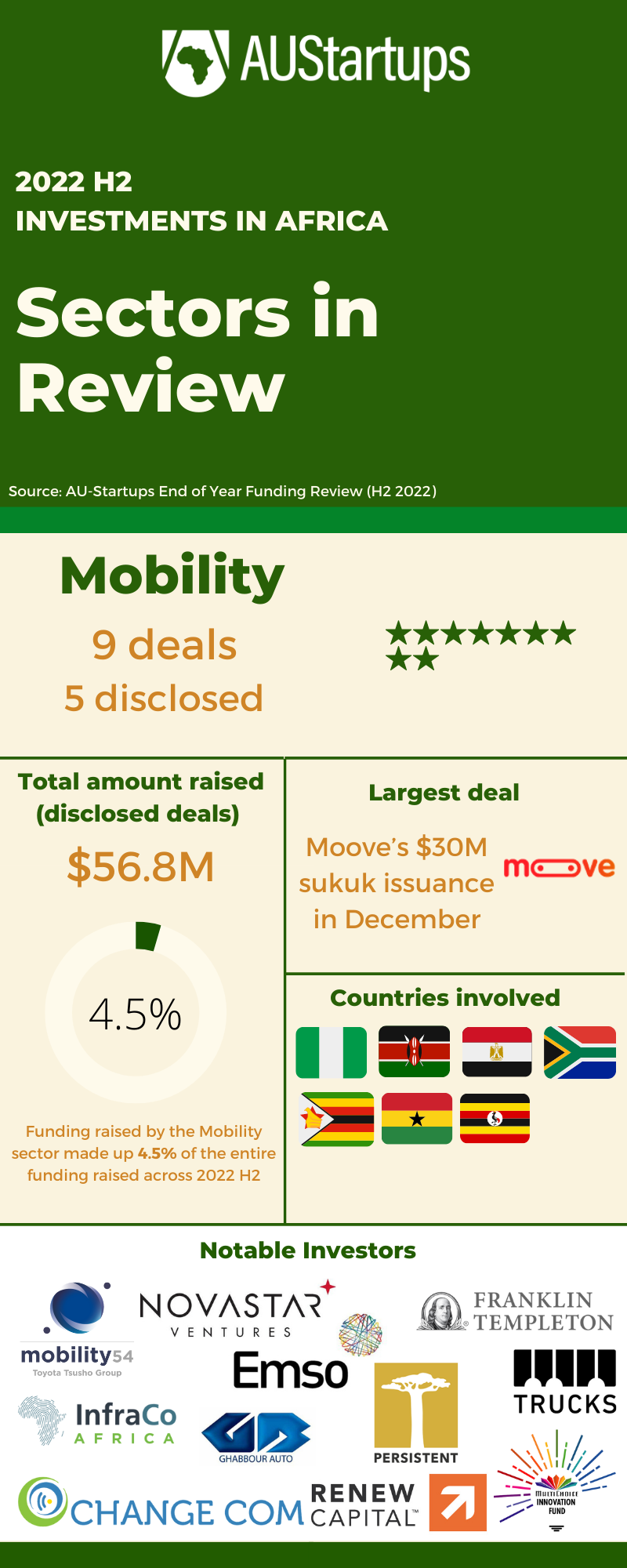

Mobility

In the mobility sector, there were 9 deals in total, with only 5 of them being disclosed. The total amount raised in disclosed funding was $56.8 million, with Moove’s $30M sukuk issuance in December being the largest single deal. Nigeria, Zimbabwe, Egypt, South Africa, Ghana, Kenya and Uganda saw investments in their mobility sector during this period.

Notable investors in the sector include Franklin Templeton, Emso Asset Management, Infraco Africa, Mobility54, Novastar, Trucks.VC, Ghabbour Auto, MultiChoice Innovation Fund, Persistent Energy Capital, ChangeCom and Renew Capital.

Energy

A total of six deals were announced by startups in the energy sector, with a cumulative $42.29 million being raised. Solarise Africa’s $33.4 million debt financing deal in November stood out as the highest single deal in the sector. Mauritius, Kenya, Egypt, Nigeria and Algeria were the countries that saw investments in the energy sector.

The Facility for Energy Inclusion (FEI), Oikocredit, Electrification Financing Initiative, Seedstars African Ventures, Aruwa, Qatar National Bank ALAHLI, Maroc Numeric Fund II were among the notable investors in this sector.

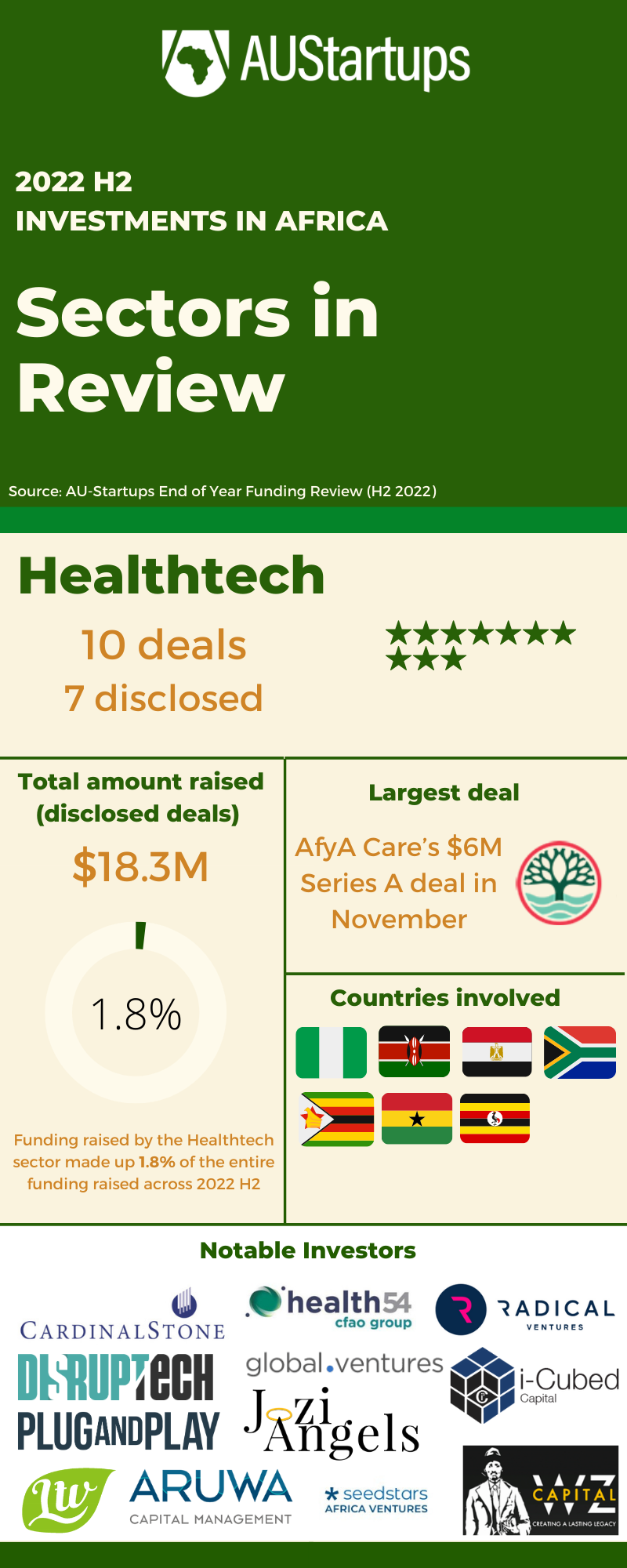

Healthtech

In the healthtech sector, ten funding deals took place, with only seven being disclosed. Overall, a total of $18.34 million was raised, with AfyA Care’s $6M Series A deal in November being the largest. The countries that saw investment in their healthtech sector include Nigeria, Egypt, South Africa and Rwanda.

Notable investors in the healthtech sector include CardinalStone Capital Advisors, Global Ventures, Health54, Aruwa Capital Management, Radical Ventures, Disruptech Ventures, iCubed Capital, Plug and Play, WZ Capital, Jozi Angels Network, Lifetime Ventures, and Seedstars.

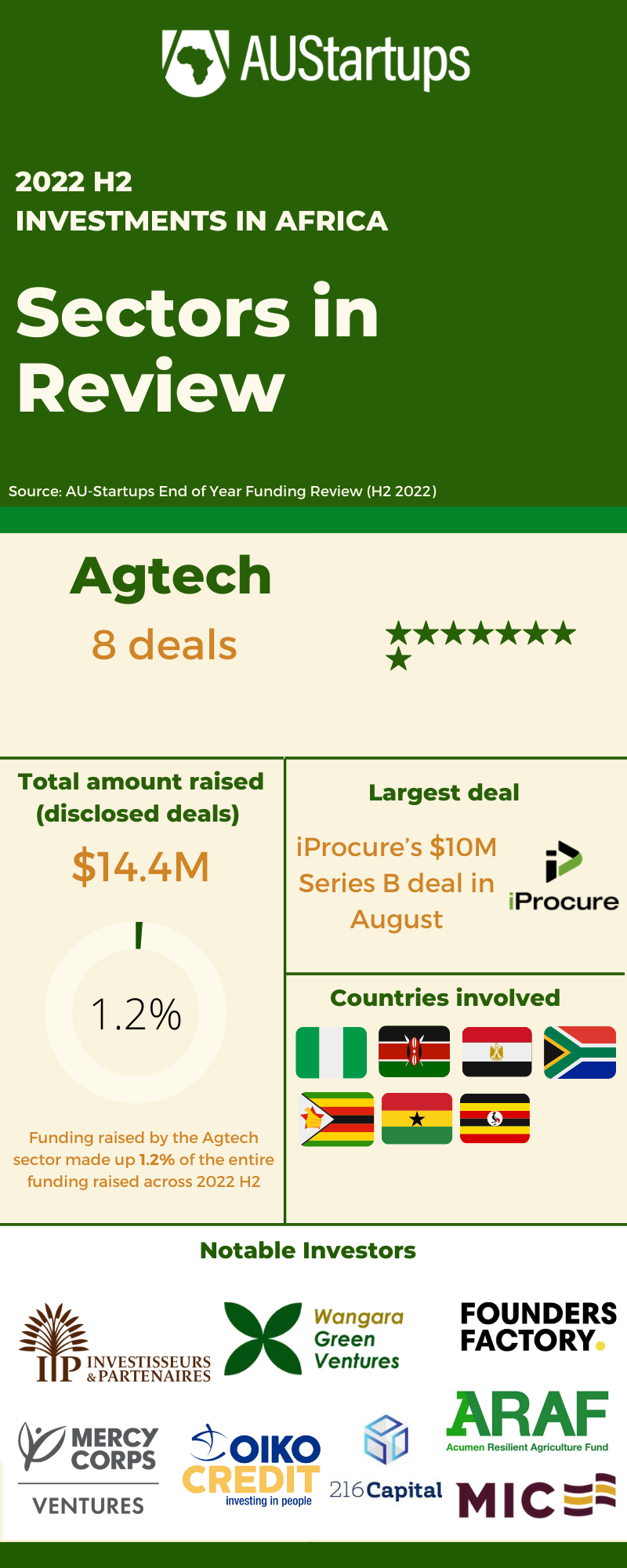

Agtech

Eight deals in total were recorded in the agtech sector, with a cumulative sum of $14.4 million being raised. iProcure’s $10 million Series B deal in August had the distinction of being the largest single deal recorded in this sector. The countries which saw investment in this sector were Kenya, Ghana, Nigeria, Tunisia and South Africa.

Some of the notable investors in this sector include Investisseurs & Partenaires, Oikocredit, Founders Factory Africa, 216 Capital Ventures, Acumen Resilient Agricultural Fund, Mercy Corps Ventures, Mineworkers Investment Company and Wangara Green Ventures.

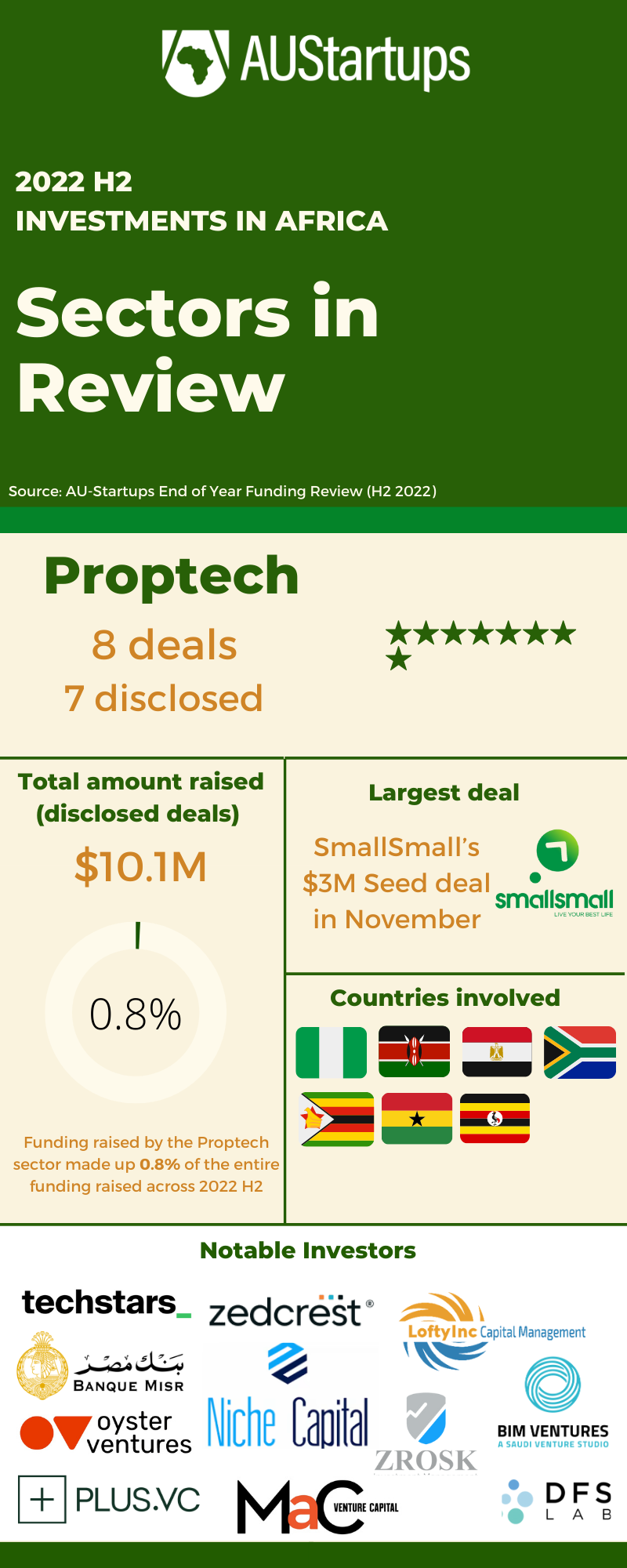

Proptech

The proptech sector saw a total of eight deals, out of which seven were disclosed. The cumulative amount raised in disclosed funding was $10.17 million, with SmallSmall’s $3 million seed round in November being the largest deal recorded. Nigeria, Egypt and South Africa were the countries that saw investment into their proptech sector.

Notable investors in this sector include Techstars, Oyster VC, Asymmetry Ventures, Vivaz, Niche Capital, MaC Ventures, Nclude, Plus Venture Capital, BIM Ventures, Zrosk Investment Management, Zedcrest Capital, DFS Lab, LoftyInc Capital and Banque Misr.

Foodtech

In the foodtech sector, six funding deals took place, with a total of $9.1 million being raised. The largest deal was Orda’s $3.4 million seed round in November. The countries which saw investments in this sector include Nigeria and Egypt.

Among the notable investors in this sector, we have Quona Capital, FinTech Collective, Nclude, A15, Innlife Investments and Y Combinator.

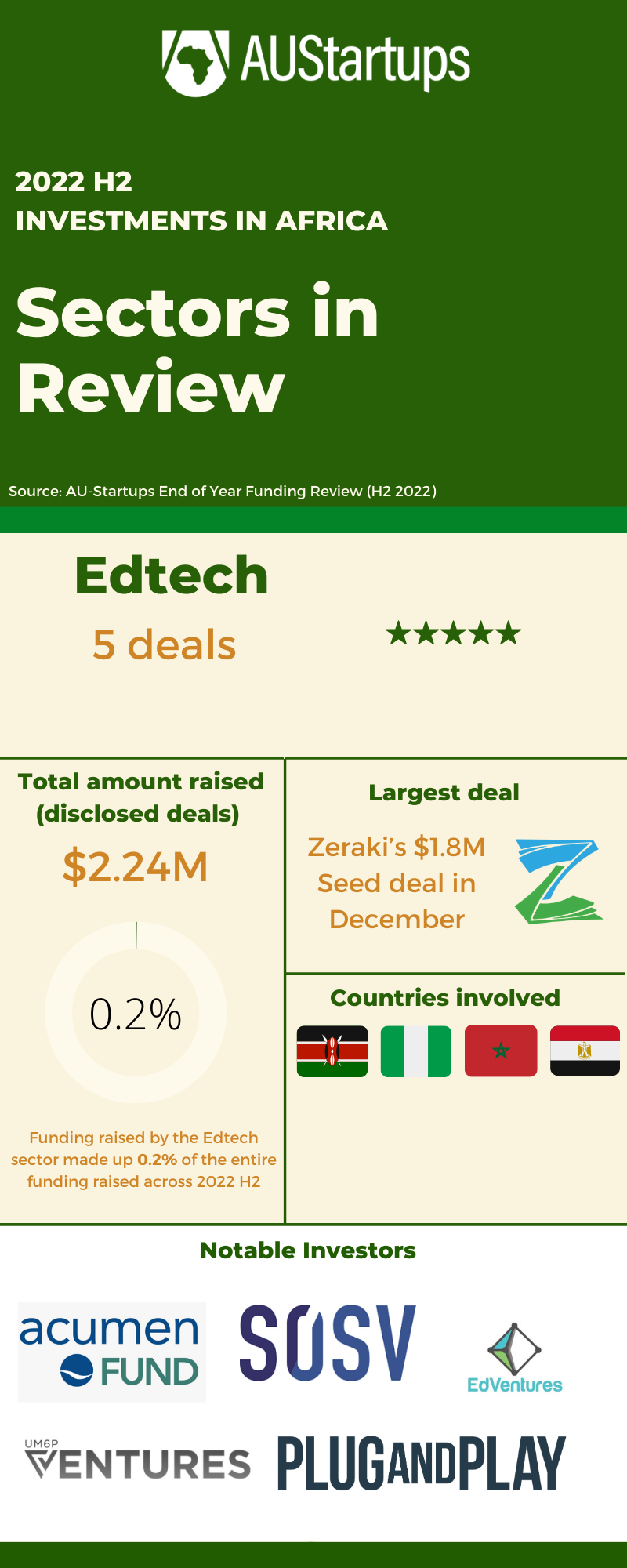

Edtech

The edtech sector saw five funding deals with a total of $2.24 million invested into the sector. The largest deal in the sector was Zeraki’s $1.8 million seed round in December, and the countries involved include Kenya, Nigeria, Morocco and Egypt.

Some of the notable investors in this sector include Acumen Fund, SOSV, UM6P Ventures, Plug and Play and EdVentures.

Source: AU-Startups End of Year Funding Review (H2 2022)