Last week witnessed significant activity in the African startup ecosystem, with a total of 11 funding rounds taking place. In addition, The Baobab Network unveiled its newest cohort, consisting of five promising startups from Kenya, Togo, Nigeria, Guinea, and Morocco.

Pre-Seed

Messenger, a Nigerian logistics platform, has recently completed a pre-seed funding round, the exact amount of which has not been disclosed. The round was led by Nama Ventures, with participation from Aidi Ventures and notable angel investors.

Founded in 2018 by Essien Etuk and Amanda Etuk, Messenger aims to digitalize the retail supply chain in Nigeria through its comprehensive logistics platform. It offers end-to-end logistics and supply chain services, acting as a single platform that handles financing and aggregation.

The funding will provide Messenger with the necessary capital to support its growth and expansion plans, particularly in establishing a strong presence in the last mile logistics market in Africa.

Talstack, a Nigerian talent upskilling startup, has recently secured $850,000 in a pre-seed funding round led by Ventures Platform, with participation from Voltron Capital, Golden Palm Investments, and TLcom Capital.

Founded by Seni Sulyman and Kayode Oyewole, Talstack aims to provide online courses, mentorship, and an all-in-one platform tailored to the specific needs of African businesses. The startup offers customized training programs delivered by experts with direct operating experience in Africa’s dynamic startup ecosystem.

The funding will support Talstack’s mission of offering businesses a comprehensive platform for upskilling their employees.

NewComma, an Africa-focused social media platform empowering African and Black creatives, has successfully concluded its pre-seed funding round led by SFC Capital.

Founded in 2020 by Natalie Narh, NewComma provides a digital space for creatives to showcase their portfolios, connect with professionals, and explore job opportunities. The platform offers budget-friendly, data-driven recruitment tools that promote diversity within global companies while helping employers discover exceptional talent.

This funding will greatly accelerate the technological development of NewComma, enabling African and Black creatives to reshape the global creative industry.

Seed

Peach Cars, a Kenyan automotive marketplace, has recently raised $5 million in seed funding round led by The University of Tokyo Edge Capital Partners (UTEC). Notable angel investors, including Shintaro Yamada, Peter Kenevan, and Hiroaki Ohta, also participated.

Founded in 2020 by Kaoru Kaganoi and Zachary Petroni, Peach Cars operates primarily in the Kenyan market and has plans for expansion across sub-Saharan Africa. The company’s core mission is to democratize car ownership in the region by providing a trusted and transparent platform for buying and selling used cars.

The funds will be used to recruit additional talent, enhance research and development (R&D) efforts, and further develop the company’s technological solutions.

Eze, a Nigerian B2B electronic wholesalers marketplace, has successfully raised $3.7 million in an oversubscribed seed round. The investment comes from a consortium of backers, including Y Combinator, Right Side Capital, C2 Ventures, Boro Capital, EVPI Investments, Itochu, Jack Greco, and a group of angel investors.

Founded in 2020 by Joshua Nzewi and David Iya, Eze has quickly established itself as a prominent player in the secondhand electronics market, expanding its operations by partnering with suppliers from Japan and Hong Kong and setting up a strategic facility in Dubai. Eze operates as an advanced B2B marketplace, seamlessly connecting distributors, retail stores, and electronics suppliers.

The funding will enable Eze to enhance its platform and provide a comprehensive solution that addresses the challenges faced by B2B traders.

Others

OmniBiz, a Nigerian-based B2B e-commerce company, has received an investment from Aruwa Capital Management. The specific investment amount and details have not been disclosed.

Founded in 2019 by Deepankar Rustagi, OmniBiz offers comprehensive retail operations solutions for manufacturers, distributors, logistic partners, and retailers in Nigeria and Africa. The company initially began as a salesforce automation software provider, serving brands and distributors in the FMCG sector.

With a tech-first approach, OmniBiz aims to streamline B2B e-commerce processes and enhance operational efficiency for its clients.

Maad, a Senegalese retail marketplace startup, has raised $218,000 in bridge funding from Proparco and Digital Africa. The investment aims to help Maad expand its innovative platform and solutions for small retailers.

Founded in 2021 by Sidy Niang and Jessica Long in Senegal, Maad’s platform streamlines the procurement process for retailers, providing fast delivery services, competitive prices, and financing options to optimize their cash flow. By leveraging the data generated by the platform, Maad enables suppliers to accurately track their sales and improve restocking processes.

The funding will enable Maad to accelerate its growth until its next funding round (Series A). It will also support Maad’s expansion into other French-speaking African countries and the development of new offerings for small retailers.

Maltento, a South African insect-based feed producer, has secured $3.3 million in a capital raise led by Sand River Venture Capital.

Founded in 2018 by Dean Smorenburg, Maltento specializes in unlocking functional compounds in insect-based feed solutions. Its primary markets are in the animal feed industry, serving both local and global clients.

The investment will enable the company to accelerate its unique approach to insect biotechnology and further develop its pioneering palatability enhancer, Palate+. Additionally, the funding will facilitate Maltento’s expansion into new markets, including the United States and the European Union.

Trella, an Egyptian logistics startup, has recently raised $3.5 million in funding from Avanz Capital Egypt.

Founded in 2018 by Omar Hagrass, Ali El Atrash, Pierre Saad, and Muhammad El Garem, Trella operates as a platform connecting shippers with trucks in real time. In addition to Egypt, the startup has expanded its operations to include Saudi Arabia and Pakistan.

This funding round follows Trella’s successful securing of $6 million in debt funding last year from ALMA Sustainable Finance (ALMA) and the US International Development Finance Corporation (DFC).

Termii, a Nigerian communications platform-as-a-service startup, has recently raised $3.65 million in new financing, bringing its total funding to approximately $5 million. The investment round was led by Ventures Platform, with participation from FinTech Collective, Launch Africa Ventures, Nama Ventures, Aidi Ventures, and others. Notable angel investors such as the Afropreneur Angel Group, Aubrey Hruby, and Eamon Jubbawy of Onifido also took part.

Founded in 2017 by Gbolade Emmanuel, Ayomide Awe, and Atinuke Idowu, Termii operates as a communications platform-as-a-service with an API-based infrastructure that empowers businesses, particularly fintechs, to enhance customer engagement through various communication channels.

The primary goal of this investment is to support Termii’s expansion initiatives. The funds will be utilized to develop and promote both existing and new products in new markets. With this investment, Termii aims to drive growth and expansion, fulfilling its mission to provide exceptional communication channels to businesses across Africa.

FairMoney, a Nigerian fintech startup, has raised $5.39 million in a Series 1 Commercial Paper Issuance. United Capital Plc, Renaissance Capital Africa, FBNQuest Merchant Bank, and Stanbic IBTC Capital Limited provided financial advisory services for the transaction.

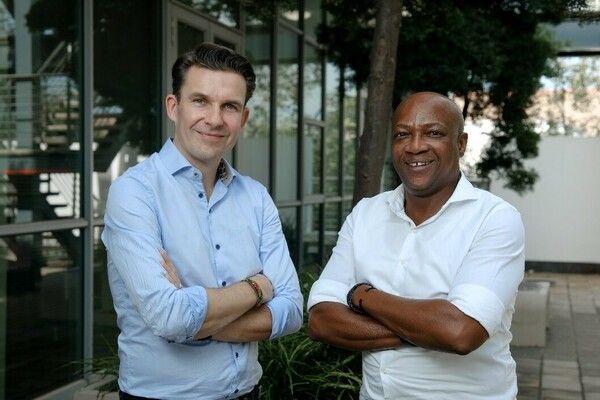

Founded in 2017 by Laurin Hainy and Henry Obiekea, FairMoney offers a range of digital financial products including digital loans, investment products, savings, payments, and cards directly via its mobile app. The company envisions becoming the financial home for the next 2 billion underbanked people in emerging markets.

The Baobab Network, an African tech accelerator has announced its latest cohort, which includes five new startups from Kenya, Togo, Nigeria, Guinea, and Morocco. Each startup will receive a $50,000 capital injection to support their growth.

Afrigility (Kenya) is revolutionizing East African logistics with its asset-light technology, offering B2B e-commerce fulfillment and on-demand warehousing solutions.

Eazy Chain (Togo), formerly Togo Cargo, provides an integrated logistics solution that includes air, sea, and road freight services, facilitating seamless cargo transportation.

ePoultry (Nigeria) is an agriculture marketplace that offers poultry farmers input credits, advisory services, and a dynamic B2B marketplace to eliminate systemic inefficiencies by leveraging data from its network of over 1,000 farmers.

MuduPay (Guinea Conakry) has developed a platform that enables Africans to move money through online payments from anywhere using their world-class technology stack.

Colis.ma (Morocco) is a progressive logistics marketplace. Colis allows transporters to digitize their operations and helps customers find, compare, choose, and track their transportation based on individual preferences.

In addition to the $50,000 USD investment, each company will benefit from a customized accelerator program led by experts. This program will facilitate valuable connections with leading angels and venture capitalists through a Demo Day.

Venture Funds

Avanz Capital Egypt is expanding its investment portfolio by launching two new funds that will diversify its offerings and support different sectors.

The first fund focuses on providing support to small and medium enterprises (SMEs) in Egypt. Its aim is to offer capital and resources that will fuel the growth of these enterprises, contributing to the overall development and expansion of the Egyptian market. The initial closing of the Avanz Manara Fund in March collected around 905 million pounds, with 25% of the amount already paid.

The second fund is dedicated to low-carbon projects and will issue “carbon credits” under the name “EGYCOP.” With an initial target of raising one billion pounds, this fund demonstrates Avanz Capital Egypt’s commitment to sustainable investments and the transition to a greener economy. By capitalizing on opportunities in the low-carbon sector, the company aims to drive positive environmental impact while generating attractive returns for investors.

Comments 2